mPIN | user ID | transaction password | limits | bill payment online

The first step in navigating the Axis Bank login is to enter your user id and password. You can

do this by using your Axis bank customer id and password. If you have a corporate account, you will need a corporate id to log in.

Once you have entered these credentials, you are ready to proceed. Throughout this article, you will find step-by-step instructions that will guide you through the entire process.

Axis Bank Login: mPIN

If you’re using Axis Bank internet banking, mPIN is a 6-digit security code that is unique to you. It is sent to your mobile phone through an SMS message after you log in to your account.

It is used to secure your account from fraudulent activity. If your mPIN is stolen, it is your responsibility to change it immediately to avoid further troubles. Here’s how you can do it.

First, you’ll need to enter an mPIN (one-time password) and debit card details. You can then transfer funds to your account or another account in Axis Bank’s network.

In order to transfer money to a payee, you’ll need to enter the IFSC or account number of the person you’re sending money to. You can enter an image for the payee’s name, which is optional.

Once you’ve entered the payee’s details, the mPIN and OTP will be validated, and the transfer will be completed.

To use Axis Bank’s mobile app, download the app on your smartphone. You’ll need an iPhone or Android smartphone to access the app.

You can download the Axis Bank app from the Play Store. To download the app, you’ll need to send “mbanking” to 567678. Make sure to enter your PIN and password correctly to avoid any problems with your account.

Once you’ve created an account, you’ll be prompted to set up your mPIN to ensure that you’re authenticated every time you use Axis mobile banking. This is a secure way to log in to your Axis Bank account and manage your account.

You’ll be prompted to enter your internet banking login ID and password. After that, you’ll be prompted to enter your debit card number. Then, you’ll be directed to the login page where you can set up your password.

Axis Bank Login: User ID

To activate Axis Bank Internet Banking, all you have to do is provide your User ID and password. This will give you access to your online account and all the features it offers.

In addition, you can use the internet banking portal to make payments and transfers. You can even stop and start cheque payments and update your PAN. Here’s how you do it:

To log in to your account, first enter your User ID, password, and registered mobile number. Enter your User ID and password and click on “Log in”.

You’ll then see your dashboard. Click on “I have a debit card” and follow the prompts. In the future, you can change your password at any time. The login ID you use is unique to you, so make sure it’s as personalized as possible.

In order to get started with Axis Bank’s internet banking, you’ll need a debit card and a mobile number. You can register your phone number at an Axis Bank ATM.

To create an Axis Bank user id and password, you must choose the currency you’d like to use, which is INR.

Be sure to accept the bank’s terms and conditions before proceeding. If you’re a non-resident of India, you can use your debit card number or your Passport number to generate a password online.

The Axis Bank login page has a “Forgot Password” link. You’ll need to enter your Axis Bank user id, password, and registered mobile number to complete the login process. Once you’re in the account, you’ll see your balances and other information. To log out, click on “Logout”.

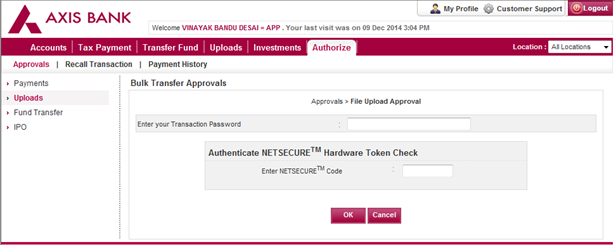

Axis Bank Login: Transaction Password

In order to set an Axis Bank transaction password, you must sign up for net banking through the Axis Bank website. You can do this by using your nine-digit customer ID or registered mobile number.

Once you have signed up, you will be directed to the next page where you need to enter your debit card details and a four-digit PIN. You will then be asked to set a password and confirm it.

In order to access your online bank account, you must have your user ID and password. You can also use a password generated from your account. It’s best to keep this password confidential, and not store it on a computer.

Layers of protection

In addition, if you use a credit card, you should never send the password by email. Instead, use the password to access your online banking account. Once you have created a password for your Axis Bank account, you should be able to use it to sign in to your account.

If you have forgotten your transaction password, you have two options: log into the bank’s online account and follow the instructions on the screen. You can also change your password offline, though you may find this less convenient.

If you don’t have an email address, you can send a self-attested copy of your id proof to the bank. They will then send you your temporary password via mail within two or three days. In addition to changing your password, you can also register for SMS banking.

If you have forgotten your Axis Bank transaction password, you can easily reset it online. The first step in setting up Net secure is to register for internet banking. Once you have registered, the bank will send you a 6-digit OTP to verify your identity.

Once you’re registered, you can log into your Axis Bank account to complete your online transactions. You will then be prompted to confirm your new password by answering a security question.

Limits on payments

If you use Axis Bank’s internet banking service, you can make payments by NEFT, RTGS, IMPS, and credit cards. To make a payment, all you need is your user ID and password, along with the NETSECURE code.

You will then see a successful transaction notification. Once you’ve finished, you can download and save an e-receipt of the transaction, and even pay a bill using your credit card.

You can change your limits by logging into Axis Bank internet banking. Once you’ve made changes to your account information, you can make a payment from your Axis Bank account to another bank account.

To do so, you must first log into your Axis Bank account and enter your login ID and password. Once you’ve successfully logged in, go to the ‘Transfer Funds’ section of your online banking service to make a payment.

You can also sign up for internet banking with your debit card number and registered mobile number. Once you’ve signed up for the service, you’ll be directed to a dashboard, where you can review your account details, download your account statement, make payments, and more.

Once you’re logged in, you can even pay your bills online, if you have them set up for this.

When you’re ready to log into Axis Bank internet banking, make sure you have your account number, customer ID, and debit card nearby.

Then, you’ll need to enter your Time Password. You should not share your Net Banking credentials with others – use your own personal email ID. You’ll need your account number and password in order to log into Axis Bank Internet Banking.

Bill Payment Options

If you’re in the market for a credit card, Axis Bank bill payment options can make paying your dues a breeze. You can use their mobile banking app or BHIM/UPI platform to send payments, but you’ll need your UPI pin and account details.

Payments made via credit card will be subject to approval. Alternatively, you can visit an Axis Bank branch to make your payments, though you’ll have to pay a processing fee.

You can also pay your credit card bill with a cheque, but make sure that you write the cheque in your Axis Bank credit card number. Once you drop the cheque, it will take a day or two to clear. In case you are paying through a different bank, check to see if they offer an auto debiting facility.

By chance you don’t have an Axis Bank account, you’ll want to make sure you’ve been notified when your bill is due so you don’t have to worry about missing it.

Credit Card payments

In case you have an Axis Bank credit card, you can use the bank’s online bill payment service to pay your bills. The credit card bill payment service works with over 90 billers, and you can even start a Reward Points* program through the bank, which can earn you rewards for making payments.

This service will also eliminate the hassles of long queues and late payment fees. You can also enjoy a zero-transaction fee for life and no documentation is necessary.

If you have a non-Axis Bank credit card, you can pay your bills through NEFT and IMPS funds transfer. To initiate this service, you need a non-Axis Bank account and choose to make your payment through the IMPS fund transfer.

If you have a Visa debit card, you can facilitate Visa Money Transfer through your net banking services or by calling Axis bank’s customer care center.