What is CERSAI | Steps To Register | Objectives | How Homebuyers Benefit | Search | Database | Charges | FAQ

Cersai stands for Central Registry of Securitization Asset Reconstruction and Security Interest of India. It is the online security interest registry of India. The main aim of the body is to make sure that it can prevent using the same asset as a mortgage for loans from different banks simultaneously.

Property documents are needed when you take loans from the bank. Many times people used certified copies of the same property and chose to avail loans from different banks. This allowed them to take a heavier loan on a smaller property. This necessitated the need to have a centralized record or registry of the mortgaged properties. Owing to the presence of this central record, the chances of fraud and using the same property as collateral for various loans could be severely minimized.

So, now that we have established the need for CERSAI, let us get into more details.

What is CERSAI?

The key aim of CERSAI is to prevent the fraud that happened owing to using the same property as collateral for getting several loans sanctioned at different banks. The fraudsters were making full use of the lack of a central recording system and they were applying for loans at different banks and using the same property as a mortgage.

Thanks to CERSAI registry, one could easily check if a certain property was already mortgaged to procure a loan and the owner of the property will not be able to take a further loan by using that property as collateral.

CERSAI was formed as a government company under the Companies Act, of 2013. The company has its headquarters in Delhi. The CERSAI registration is covered under the SARFAESI Act.

Before CERSAI was made, it was extremely hard for financial bodies to understand if a certain property was already mortgaged. One had to fall back on the owner and take his word to be sure that they were not using the same property as collateral at multiple banks. This of course was a dicey situation and puts the banks at massive risk.

Even buyers who wanted to buy property were unsure whether the property came with loans and liabilities, and therefore the whole process lacked transparency. This often led to several legal hassles.

Therefore, this portal is used by the public as well as banking bodies. There is some restriction to the kind of details that the general public can access. Nonetheless, the presence of this body made it easier both for property buyers and banks to know the details about the property.

Who Owns CERSAI?

CERSAI is a government entity that is owned by a group of Central governments, the National Housing Bank, and even public sector banks. As much as 51 percent state of the company is owned by the Central Government. The NHB with the rest of the banks makes up the remaining half.

Registering Entity On CERSAI

The entity registration process is very simple and has just a few steps. Let us list it down for you to give you a clear picture.

- Go to the home page of the CERSAI site which is https://www.cersai.org.in/CERSAI/entityregn.prg

- Now on the homepage, click on the tab that reads ‘Entity Registration’.

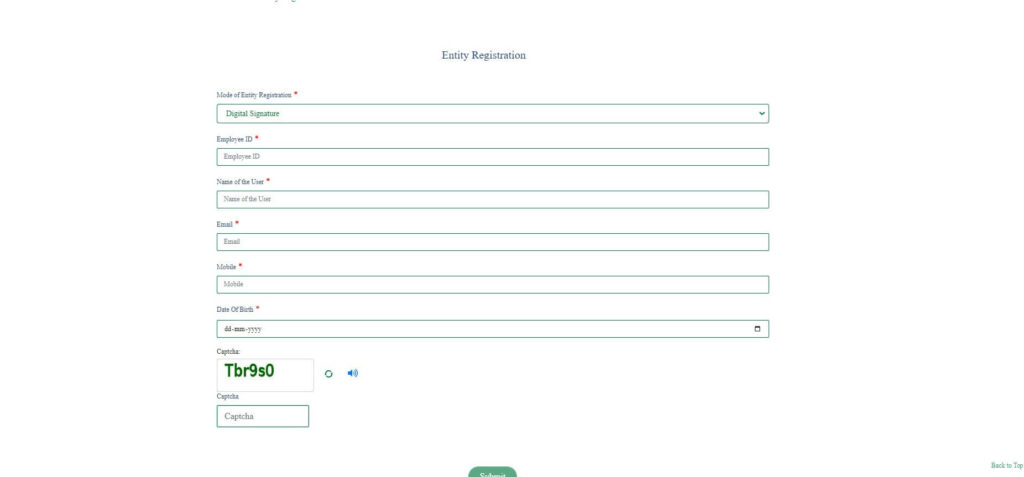

- In the window that opens, hover over the ‘mode of entity registration’ dropdown list and select the ‘CKYC’

- You will be prompted for several details like the CKYC number, the date of birth and so on. Fill in these particulars and then click the ‘submit’ button

- You can choose the ‘digital signature’ option. If you do so, you will need to fill in the following details: employee ID, User name, Email, Mobile Number, Date of birth, and the captcha.

These are the simple steps that you should follow and you will be able to register the entity easily.

The Functions And Objectives

Here are some of the key functions and objectives of CERSAI

- The reason CERSAI was formed is that they wanted to have a central registry of the collaterals. The details present include the property information that has been used as collateral, the financial body that gave the credit, and the details of the borrower. This is the complete set of information.

- The CERSAI enabled lenders to register their asset reconstruction and securitisation transaction details.

- The portal allows the lenders the power to ascertain whether or not the property against which the loan is being sanctioned has been used as collateral by some other bank

- Further banks can easily check the records and see if the value of the property is huge enough to extend the loan

- The portal is very helpful for home buyers to check if the property they are willing to purchase is free from liabilities and has not been mortgaged

- As per the factoring Act, 2012, the scope of CERSAI was changed. Now CERSAI can also register the security interests that were created through either account receivables or even factoring

- The scope was further enhanced in 2016. The CERSAI is now required to start the registration of surety interests that were created on movable and intangible assets. These include accounts receivables, book debt, and even hypothecation.

- It is compulsory to register all types of mortgages that are present across India.

How Do Homebuyers Benefit From The CERSAI Portal?

Before the Real Estate Region and Development Act of 2016 came into place, the verification activities were very limited in their approach. A lot of home buyers were often cheated and they were made false promises that were never delivered. Plenty of disputed properties were also sold.

These things came to a screeching halt after CERSAI was launched. This portal gives the homebuyers the provision to check if their shortlisted property has an ongoing mortgage or if it has any liability overhead. So, it saves them both the money and the legal battles.

What Is The CERSAI Search?

As endless people had resorted to the unfair mean of using the same property and collateral in multiple banks, the CERSAI portal integrated the option of CERSAI search.

This search option will enumerate the details of the chosen property and it will therefore help the user know if it has been mortgaged for the sake of a loan. You simply need to click on the public search tab on the home page of the CERSAI site.

There are three broad ways by which you can search.

- Asset-based

- Debtor based

- AOR based

The Database

It is very important to keep the CERSAI updated at all times or else it will defeat the whole purpose of having the portal. If the property details aren’t updated, how will the other banks know if the property is already mortgaged or not?

This is why every time a bank either processes or even disburses a loan, they need to update the details on the CERSAI database. This process of updating the details is known as the registration of charges.

As per the law, banks need to update the information within 30 days of finalizing the loan. If the banks fail to update the details, they will be penalized monetarily by the RBI.

The CERSAI Charges

Whenever any individual approach the bank to procure a loan against a property, the first thing that the bank will do is conduct a thorough search of the property. This is done to make sure that no liability is present on the property.

To carry out these checks, records have to be pulled from the database. There is a fee to be paid to do this. However, an interesting thing to add here is that the bank doesn’t pay this charge. They transfer this fee to the loan seeker. This fee is called the “memorandum of the deposit of deed fee’.

Another important point to bear in mind is that the CERSAI charges have to be paid even if the bank doesn’t sanction the loan to the individual. As CERSAI was accessed and searched, the fee has to be paid mandatorily.

The Registration Charges

When the security interests are registered, CERSAI makes it a point to levy a fee. The fees for CERSAI registration vary from Rs. 50 to Rs. 100. The fee amount will depend upon the amount of loan that has been finalized against the property.

Here are the complete details of the charges that are levied.

- For transactions involving the creation or modification of security interest, the charges are Rs. 50 for loan amount up to 5 lakhs and Rs. 100 for a loan amount above 5 lakhs

- If an existing security interest has been satisfied, the charges are nil

- For reconstruction or securitisation of a financial asset, the charges are Rs. 500

- When the reconstruction or securitisation of a financial asset is satisfied, the charges are Rs. 50

- For searching CERSAI to retrieve information, the charges are Rs. 10

- For assigning receivables, the charges are Rs. 10 if the value is less than 5 lakh and Rs.100 for amounts above that

- If the registration of realisation of receivables has been satisfied, the charges are not there

- Any condonation of delays up to 30 days for assigning the receivable will be charred at ten times the basic fee

So, the fees charged are usually very basic but it is in place to make sure no unnecessary accessing is done. The CERSAI has emerged as one of the most useful tools for both banks and home buyers as it has eliminated the chances of too many frauds and structured the whole loan system.

The added transparency has turned out to be very handy and beneficial. Recently, an upgraded version of the portal was launched.

FAQ

What does CERSAI stand for?

CERSAI stands for Central Registry of Securitization Asset Reconstruction and Security Interest of India

What is CERSAI 2.0?

The v 2.0 is the upgraded version. It is mainly used for registering entities of securitization by the banks

Who is the biggest stakeholder in CERSAI?

The Central Government holds as much as 51 percent stake in the company.

Under which law was CERSAI established?

CERSAI was incorporated under the SARFAESI Act, 2002

Do you need to pay a fee for accessing CERSAI records?

Yes, when a CERSAI search is made, you are bound to pay a fee to the CERSAI even if the loan isn’t sanctioned ultimately

Can CERSAI also be accessed by home buyers?

Yes, even regular public-like home buyers can access CERSAI for checking if their chosen property is free of liabilities and legal hassles.

Is CERSAI constantly updated?

Yes, banks need to update the property details within a period of a maximum of 30 days from the time of loan finalisation