revenue payment | pay my land tax | khajana In odisha | offline land taxes | odisha e-pauti platform | transaction ID | e-pauti app | faqs

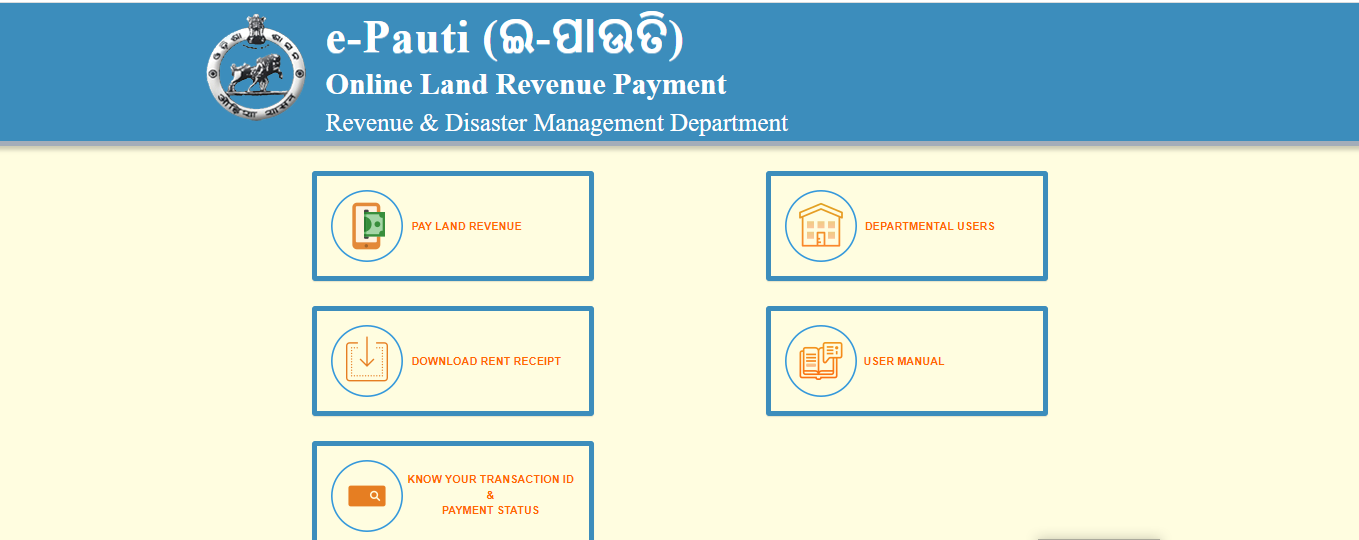

Here is all you need to know about the e-Pauti portal, which is Odisha’s online platform for making payments relating to land transactions.

Payments for land taxes may be made online on the official website of Odisha’s Revenue and Disaster Management Department, just as they can be in other states. Landowners in the state of Odisha can now make large payments online using either the e-Pauti Odisha portal or the Odisha land revenue payment website.

Using the PAUTI online portal or the PAUTI mobile app, residents of Odisha can pay the land tax that they are required to pay at any time and from any place.

The National Informatics Centre in Bhubaneswar, Odisha, is responsible for developing the e-Pauti website, which had its official debut on August 5, 2020.

Access to IDs for transactions, online payments for land revenue, downloading and checking rent receipts, and so on are only a few of the numerous services made available by the Odisha e-Pauti site. Other features include:

Land Revenue Payment Needs Specifics

It Is Necessary to Provide Precise Information to Pay Land Revenue. Landowners in the Indian state of Odisha who intend to make an online payment of the khajana, also known as the land income, are required to have the following information.

- The Odisha record of rights Indicator number

- The mobile phone number attached to the account

- The passwords for your internet banking, debit card, or UPI

- This information is essential

How can I pay my land tax over the Internet?

The procedure for submitting an online payment for land revenue is broken down into steps in the following section.

- To begin, go to www.odishalandrevenue.nic.in and choose ‘Pay Land Revenue’ from the menu that appears when you click the drop-down arrow.

- This is the second stage, and it is vital that you fill out every form with extreme care and then click the “proceed” button. Filling up this form requires noting the fiscal year for which the khajana is paid, the names of the tehsil, village, and district, the total area of the land, the khata number, and the tenant’s name. In addition, information about the rent, the water tax, the N Cess, the cess, and any other applicable taxes is required.

- In Step 3, you will be required to input the depositor’s name, the depositor’s connection to the registered renter, the depositor’s address, email address, and mobile phone number. After that, choose “proceed” by clicking on the link.

- At this moment, the page for the payment gateway will appear on the screen for you. You may choose your preferred payment method from among the many available options. Alternatively, you might use a debit card, an online banking account, or a UPI account. After you have chosen your selection, go to the payment page.

- When you click “Proceed” to go on from the Treasury page, you will be sent to a page that confirms your action. There is a choice that allows you to “confirm.” After this step, you will get the Treasury Challan Reference ID you need. Keep this Treasury Challan Reference Number safe for use in the event of future inquiries.”

- When you choose the “make payment” option, the online payment portal your bank provides will load on the screen. ” If you’ve decided to go with the online banking option, the following page will appear when you check it out on your computer.

- In the seventh step, an acknowledgement of receipt will be produced if the payment was processed successfully. You may want to save this information for use in the future.

What Exactly Does It Mean To Be A Khajana In Odisha?

This notion is referred to by the Odia term khajana, which means “revenue from the land.” Landowners in the state of Odisha are obligated to make annual payments of khajana, also known as land revenue.

You are required to have your khatiyan information on hand before you may use the e-Pauti website to make a payment in an online transaction. Make a note of both your transaction number and the challan reference number so that you can refer to them in the future. You should write down your “bank transaction ID” to keep track of your payment (or “reference number”). If there is an issue with the cost, this will come in handy.

Users of the e-Pauti Odisha website have access to three different payment options. Some examples are ICICI debit cards, SBI ePay, and online banking services.

What is the Process for Making a Payment for Offline Land Taxes?

Shared service centers, often known as CSCs in Odisha, are available for use by landowners who need to pay their land taxes.

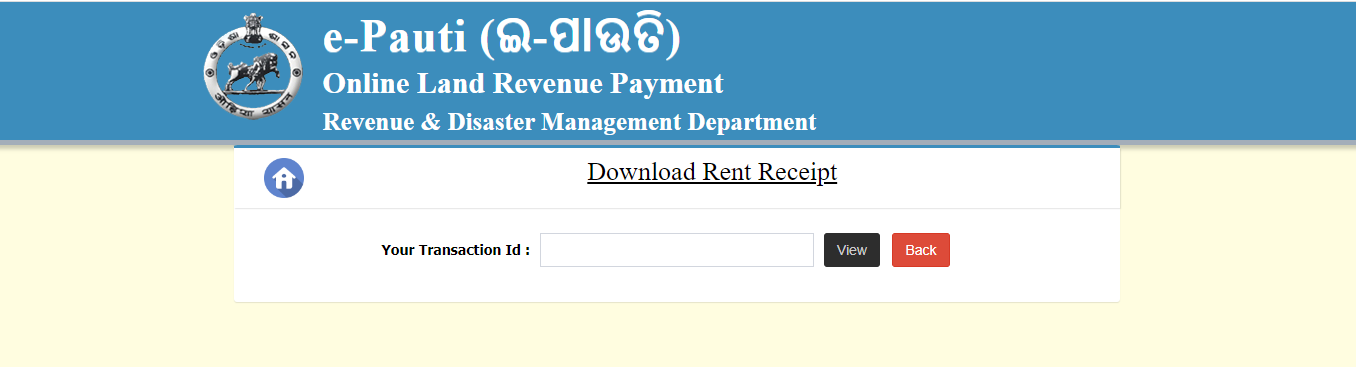

How can I acquire a rent receipt using the Odisha e-Pauti platform?

The instructions on how to receive a copy of the rent receipt from the Odisha e-Pauti website are provided in the following information.

- The homepage for E-Pauti Odisha is where you will start the process of receiving your receipt after making your payment.

- Enter the transaction ID you were given, and then click the “View” button. Step 3. The screen will now display the rental receipt in the format shown below. It is recommended that the receipt be kept for possible later use.

Transaction ID

Utilizing the transaction ID allows users of the official e-Puati Odisha website to download and validate rent receipts. If you cannot discover your transaction ID, the e-Pauti website will enable you to obtain it.

This step-by-step instruction will walk you through the process of obtaining your transaction ID.

- The first thing you need to do is log into www.odisharevenue.nic.in.

- If you want to get your transaction ID, go to Step 2 and choose the option that says “Know Your Transaction ID.” You are about to be sent to a different page.

- You will need to choose the district, the fiscal year, the village number, the khata number, and the tehsil that you wish to input from the corresponding drop-down menus.

- In the fourth step, click the button that says “Get.” On the screen that loads after you click the button, you will see your transaction ID and the current status of your land revenue payments.

How to Use the e-Pauti App?

Now that e-Pauti has a mobile application, landowners with smartphones can take advantage of the platform’s services. Taxpayers can use the app to submit their khajana payments from any location they want.

The app has many features, some of which are as follows:

- It is possible to make payments for land revenue online, and rent receipts may be downloaded, printed, and verified using a computer.

- Khatiyan’s ability to get in knowing the transaction id is required.

FAQs

Q: How can I make a payment to Pauti using their online system?

The E-Pauti website of the Odisha Treasury may be used to make payments for land revenue. The easiest way to pay is by using a credit or debit card, an ICICI debit card, or internet banking. Other options include using cash.

Q: What exactly is e-Pauti Odisha?

e-Pauti is a website that allows landowners in Odisha to pay the yearly land revenue due to the state through electronic means.

Q: To be more specific, what does the Malgujari receipt entail?

In the simplest terms, a Malgujari receipt can be translated as a tax or revenue. The terms are recorded on the form that is made available at the time that the tax is paid.