ESIC | Eligibility for Registration | Services | ESIC mEUD Login | Rules & Coverage | ESI Code Number | Features | Benefits | Documentation | Penalty on Failure | Complaint Filing Process | ESIC Employer Login

In India, the Employees’ State Insurance (ESI) scheme is a social security program with many different parts. This plan now covers about 13 billion employees and their families. At first, only people who worked in India could join the ESI program because both the employer and the employee pay into the ESI system.

The ESI Act ensures that employees are eligible for various benefits, such as medical care, financial help, and other benefits. Its main goal is to financially protect employees in the organized sector if one becomes disabled because of an accident or health issue. You can easily avail of this service through the esic employer login portal.

Check out the details on e-stamping up and e-shram card.

What is ESIC, and How Does it Work?

The Employees’ State Insurance Corporation, or ESIC, is a separate organization that works under the Ministry of Labor and Employment. The main goal of this group is to provide financial support for the Employees’ State Insurance (ESI) program.

It is a self-financing plan, and both the employer and the worker make payments to the ESIC. These payments pay for the plan. Employers who are required to sign up under the ESI scheme can do their ESIC registration online at esic.in, the site for ESIC registration.

The group in charge of ESIC is the Employee State Insurance Corporation (ESIC). The ESI Act, passed in 1948, says what laws and rules it has to follow. The Ministry of Labor and Employment is in charge of the ESIC. You can use the esic employer login portal to get into ESIC.

Eligibility for Registration with the ESIC

Under this system, the employer contributes 4.75 percent of the employee’s monthly payments. In comparison, the employee is only responsible for contributing equally to 1.75 percent of his monthly payment yearly.

Workers who work in businesses with more than 20 employees, like hotels, restaurants, newspapers, road-motor transport companies, movie theaters, and private educational and medical institutions.

Any non-seasonal factory or business with more than ten employees (or 20 employees in some states) who make a maximum salary of Rs. 21,000/- is required by law to register with the ESIC within 15 days of the date on which it became applicable. If the maximum salary is Rs. 21,000/-.

Also, if an employee’s maximum pay is less than $15,000, a business must register with the ESIC site to follow the law. The ESI contribution rate is the amount that both employers and employees have to pay into the system, and the rates for ESI contributions are worked out separately.

Services by ESIC Portal

- Employer Services

- Employee Services

- Medical Benefit Rate

- ESIC IP Portal login

- Employer Portfolio

- Shram Suvidha

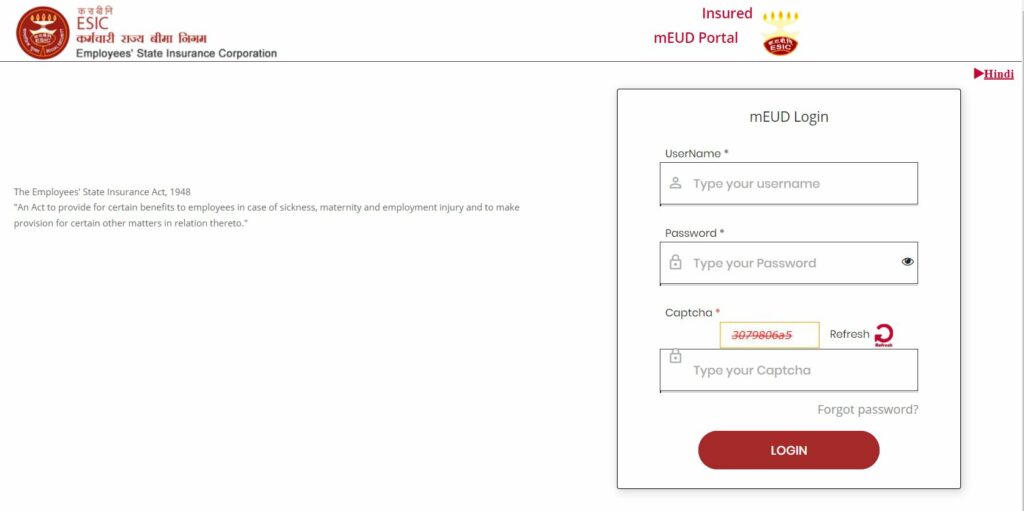

Login to ESIC mEUD

- Users can sign in to the ESIC website by choosing the mEUD option from the menu.

- Fill in the required fields with your esic employer login information, including your username, password, and the captcha code.

- Click the “Login” button to keep going with the sign-in process.

What are the Rules for When the ESI Applies, and How Wide is its Coverage?

If you had ten or more employees at any time in the previous year, you had to register with ESIC. But insurance premiums are only taken out of the paychecks of people who make less than or equal to INR 21,000 per month. In some states, you can only sign up for ESIC if you have at least 20 employees.

What is the number that goes with the ESI Code?

The ESI Code number is a 17-digit code unique to each worker at an ESIC-Registered plant or facility. Each worker will get an ESI Code number. When an employer sends information about an employee to the ESIC website, the website generates a 17-digit number.

Features of the ESI Scheme

- A worker who makes an average of Rs 137 per day can get a contribution from their employer. This payment comes from the employer’s portion.

- The employee’s contribution rate is 0.75 percent of their earnings, and the employer’s contribution rate is 3.25 percent of the wages to workers in each wage period.

- Within 15 days of the last day of the month for which the payment is due, employers must pay their share, take workers’ shares out of their pay, and send the total amount to ESIC.

- Members of ESIC can get the most up-to-date information about Benefits and Contributions by downloading the ESIC mobile app to their phones.

- You can also use the online payment option through public institutions.

Benefits of ESI Registration

- As soon as a person starts working at a job covered by insurance, he or she and his or her family can get full medical help. No limitation on how much therapy will cost, either for the person or the whole family.

- If he cannot work permanently, there is an option for a monthly payment of 90% of his salary.

- When a person with health insurance who has had it for more than three years loses their job, they are eligible for unemployment benefits. An insured person can get money for unemployment if they have been covered for three years or more and have lost their job because a factory or other business closed or they were laid off.

- If an employee dies because of an accident at work, his or her dependents will get 90 percent of the person’s salary as a monthly payment after the person’s death.

- Employees and workers covered by the ESIC Scheme can get cash benefits in case of a financial emergency caused by illness, temporary or permanent disability caused by work, maternity, injury, the cost of funeral expenses at the time of death, or physical rehabilitation.

- If an employee who ESIC covers dies, it will cover the employee’s funeral costs. From the first day, an employee is eligible for insurance and will get Rs. 10,000 as the employee’s dependents or the person in charge of their funeral.

- If an insured person needs medical care and misses work, the esic pays at 70% of the normal rate for up to 91 days in two consecutive benefit periods.

- The maternity benefit for giving birth or being pregnant is for twenty-six weeks. However, if a doctor says so, it can be extended by another month at full pay, as long as the worker has paid into the fund for at least two periods of seventy days each.

Documents Required for ESI Registration in India

- PAN card copies for the business and all of its workers

- Number of CST, ST, or GST registration

- Address proof

- Bank statement copy

- MOA and AOA of the company

- GST certificate of the establishment

- Copy of the most recent receipt for building tax or property tax

- List of who runs the company and who owns it

- Receipt for rent of the occupied property, stating its size

- Articles of Association of the company, Partnership Deed, or Trust Deed

- Utility bills

- A company’s registration certificate

- A canceled check from the company’s bank account

- Certificates and licenses of the Shops and Establishments Act

Penalty Imposed on Failure of ESI Registration & Returns

Employers will have to pay a fine of INR 10,000/- if they don’t follow the rules. For example, they won’t be able to do business if they don’t get ESIC employer login registration online or don’t finish the process for filing an ESI return.

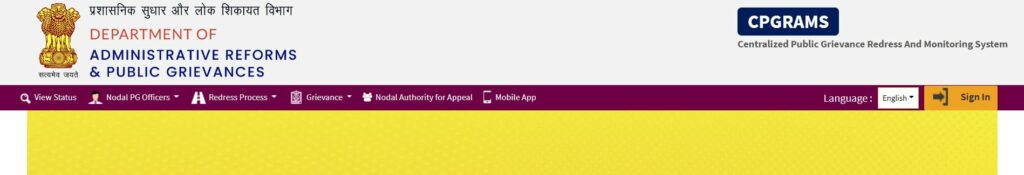

How to Use the ESIC Login Portal to File a Complaint?

On the ESIC website, people can use an online form to file complaints. Follow the simple steps-

- To file a complaint, go to the homepage and look for the link that says “register a grievance” under the section called “Public Grievance.”

- When you click this link, you’ll go to a different page.

- Choose the “Lodge Public Grievance” option under “Grievance.”

- In the “Grievance Detail” section, use the drop-down menu to choose “Others/Not Listed/Not Known.”

- Under Ministry/Department, choose ESIC from the drop-down menu. Then, select the Regional Office from the list of options under “Subordinate Department/Office.”

- Enter the complaint.

ESIC Employer Login – Online Registration Process

On the official ESIC website, an employer can sign up to be a member online. Compared to the old way of signing up for ESIC, the online system lets you log in and sign up more conveniently.

Step-1: The first thing you need to do is log in to the ESIC Portal.

Just go to the website esic. And click the “Click Here to Login” link on the home page. This will let you sign up as an employer following ESI laws.

Step 2: Fill out the information on the ESIC portal’s Sign Up page.

When you get to the “Sign Up” page, fill out the fields with the information that is asked for. This includes information about his family members, the addresses of everyone’s homes, and the name and address of the hospital where they are getting medical care or wants to get care in the future.

Step-3: Confirmation Mail

When the employer sends in the form to sign up for the portal, they will get a confirmation email. You will get the confirmation email to both the registered email address and the phone number given when signing up.

Step-4: Employers must fill out this form to register.

After you log in to your ESIC account, it will take you to a page with a link that says “New Employer Registration.” Choose the “New Employer Registration Link” link to continue the registration process.

Step-5: Pay Initial Contribution

After you send in the ESI Registration Form, also called Form-1, the “Payment of Advance Contribution” page will show up. On this page, the employer will have to enter the amount for payment and choose the option.

Step-6: Receiving Registration Letter C -11

As soon as the bank gets the challan, you will get an automatic registration letter to the email address your company has on file if you are the employer and have already paid.

We hope you have understood the esic employer login and its registration process. Let us know your feedback and suggestions in the comments section below.