Meaning | How To Check | Applicability | Land Tax | How To Pay | Updates | FAQ

The Kerala state government makes it a point to fix the fair value of land in Kerala to cut down the speculation over the net property prices. Based on this amount, the registration charges are paid. There are plenty of details associated with the fair value of the land.

If you would like to calculate the fair value of land and also know the different steps and related details, here we are going to list it for you. So, let us give you more details about the fair value of land in Kerala and you are sure to use this information to your advantage.

What Do You Mean By Fair Value Of Land In Kerala?

The fair value of land in Kerala is the amount that has been fixed by the state and it is the value, based on which the stamp duty and even the registration charges are levied. This value is also going to apply to houses and flats.

How To Check The Fair Value Of Land In Kerala?

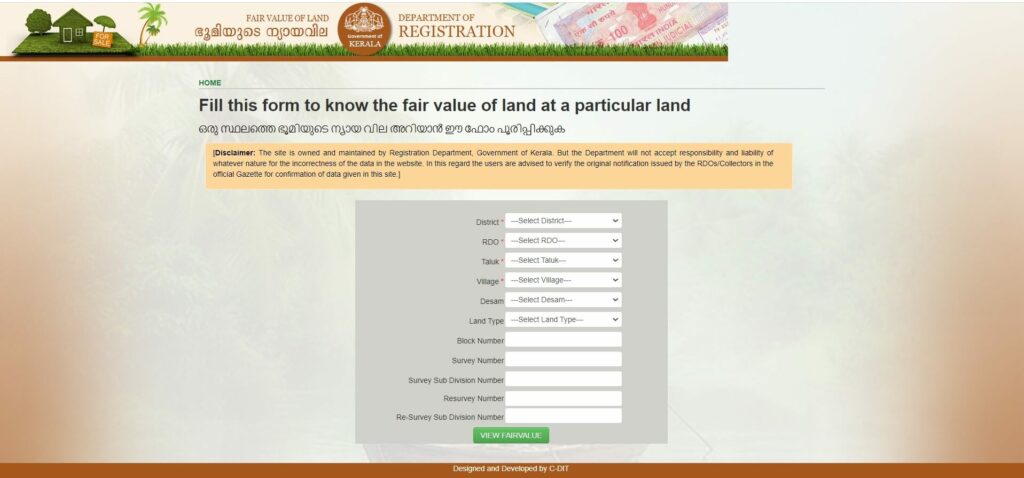

Here are the simple steps to be followed for the sake of checking the fair value of land in Kerala.

- Visit the Kerala portal and make sure to add all the particulars as asked

- Make sure to enter the details from the dropdown menu as these are all mandatory fields

- Now, make sure to select the land type, block number, survey number and other information as well

- Click on the option that says ‘View Fair Value’ and this, in turn, will take you to a new page and the results will be displayed

It is very important to note that the fair value of land in Kerala was last updated on March 31st, 2020. The department also clearly states that they will not be responsible for any incorrect data as the site isn’t updated very frequently. This is why all users should make it a point to re-check the rates with the notifications issued by the collectors and the RDOs.

The Applicability Of The Fair Value Of Land

Here are some important details with regards to the applicability of the fair value of the land. If the sale deed of the land was executed by parties before the legal land fair value was revised, the valuation will be done as per the fair value on the date the document is executed. The stamp duty and registration charges will also be calculated accordingly.

So, it is the existing rate that is always factored in to make sure that the process is seamless.

Related: Chhattisgarh Land Records Online

The Difference In Fair Value And Market Value

The land value in Kerala is fixed by the state authorities. The market value in turn is set by the marketplace. This rate takes into account several different factors including

- The current demand

- The supply scene

- The real estate trends

- The locality status

- Neighbouring areas

- Connectivity of networks

Each of these factors is crucial in judging the market value of the place.

In most cases, the stamp duty and registration of deeds are carried out based on fair value. However, if the consideration amount is higher, then it will be used for calculating the stamp duty and even the registration charges. These charges are payable to the government.

The Registration Charges And The Stamp Duty Rate In Kerala

Here is a table depicting the current rates for both stamp duty and registration charges. These values differ based on who holds the property; whether it is joint ownership or solo. Once again, the main defining clause here is gender.

Always remember that the stamp duty and registration charges are always levied on the higher amount between the fair value of land and the transaction value.

What Is The Land Tax?

After having understood the meaning of the fair value of the land, we now want you to focus on the term ‘Land Tax’.

The revenue department of Kerala has introduced a new application. Via this portal, they will be able to pay the land tax online. They will also be able to get a receipt of the soft copy or their payment details too.

There is also an integrated app called the Revenue Land Information System (ReLIS) available. You can use the portal or the app for the sake of carrying out the payments.

Related: Dharitree Assam Land Record

How To Pay Land Tax Online?

If you want to know the series of steps to follow for paying the land tax, here are the details.

- Head to the revenue website by clicking here

- Follow the on-screen steps and register yourself

- Now login to the site with your credentials and click on ‘New Request’

- Select the ‘Land Tax’ option from the list

- You will be asked to fill in several particulars and you need to do it duly

- Now click on the ‘View and Add button. This will add the information to the system

- Click on Submit

- You will get a message of approval on your registered mobile as soon as the details have been verified

- Now, login to the portal again and select ‘My Request’

- In the options available, click on the ‘Pay Now button

- Once the payment has been done, download the receipt

The Fair Value Updates

- As per the Kerala gazette notification, the property tax assessment will be linked to the fair value of the land

- Earlier, the buildings were assessed based on the annual rent they generated. Now, the norms have changed and the taxes are charged based on the plinth area

- Back in February 2020, the Kerala government announced that they had hiked the fair value of land by up to 30%. This move was heavily criticized as the realtors complained that this will shoot up the construction cost considerably. The real estate industry is already struggling after the demonetization. This massive hike in charge is going to create even more trouble as the increased rates will lead to fewer buyers and this will impact the property industry significantly.

- The government has prepared basic tax rate slabs for the different catalogues of buildings. For instance, residential, industrial, theatres, hospitals, mobile towers, and assembly buildings have all varied rates of taxes that are charged.

Related: CSC Mahaonline: A Guide

FAQ

What do you mean by the fair value of land in Kerala?

The fair value of land in Kerala is the fixed amount that the government has decided for the land

Can the market value differ from the fair value?

Yes, the market value can differ from the fair value as the market value depends on the property trend, market, and demand.

Is the stamp duty paid on market value or fair value?

The registration charges and stamp duty is always paid on the higher amount between market and fair value.

Also, try to learn the complete process of house registration in Telangana