Registration in Telangana | Land Registration | Fees | Time | Requirement | Stamp Duty | Sale Deed | Steps | Payment | Outlawed Properties | Market Value | Mobile App | Property Documents | Contact Information | Recent Hike | Procedure | Conclusion

Understanding the land and house registration process in Telangana and information about payment of stamp duty, the market value of properties in Telangana, and the document requirements for registering a sale contract is highly crucial, and even access documents online for the property and house registration in Telangana. You can also read about GST on Flat Purchases.

Details Required for House Registration in Telangana

This article contains all the details regarding the house registration process in Telangana, details regarding property registration fees in Telangana, details regarding the time required for property registration in Telangana, and details regarding document requirements for property registration in Telangana.

Essential steps for Calculating stamp duty and registration charges in Telangana, Things to know before creating a sale deed in Telangana. It also includes the steps involved in property registration, along with the Payment of stamps and identification of outlawed properties in Telangana.

Evaluation of the property’s market value with the help of the Dharani portal and Mobile app for property registration in Telangana and document requirements for the inherited property as listed in the SRO for the Patta/ Khata transfer along with contact information of IGRS Telangana is also provided.

Details Regarding Land and House Registration Process in Telangana

You should register the sales with the Telangana Registration and Stamp Departments for buying property in Telangana. The buyer and seller, along with witnesses, should visit the nearest sub-registrar’s office to pay stamp duty and registration charges per guidelines provided by the Telangana state government.

You can perform some steps of the sale registration online by uploading all the required documents. For example, recently, the market values of agricultural lands, open plots, and flats in Telangana have increased by 50 %, 35 %, and 25 %, respectively, and renewed rates are in effect from February 1, 2022.

IGRS Telangana revised charges and committees included under Telangana Revision of Market Value Guidelines Rules-1998 for changing the market values. In addition, the seller must pay the stamp duty, registration fee, and transfer duty to the Telangana land registration department per their guidelines.

Details Regarding Property Registration Fees in Telangana.

For the registration of sale of a flat/ apartment, stamp duty, transfer duty, and registration fee are 4%, 1.5%, and 0.5%, respectively. Agreement with possession certificate, the stamp duty, transfer duty, and registration fee are 4%, 0%, and 0.5%(minimum Rs 5000, maximum Rs 20000), respectively.

Sale agreement without a possession certificate, the stamp duty, transfer duty, and registration fee are 0.5%, 0%, and 0.5%(minimum Rs 5000, maximum Rs 20000), respectively.

In the registration of sale agreement-cum-GPA the stamp duty, transfer duty, and registration fee are 5%, 0%, and Rs 2000, respectively. For the registration of a will, the stamp duty, transfer duty, and registration fee are 0%, 0%, and Rs1000, respectively.

Time Required for Property Registration in Telangana

Sub-registrar does the registration of the sale deed, lease deed, agreement, contracts, etc., within 24 hours, and after the registration, he will return the document to the parties after scanning. Then the junior/senior assistant issues the encumbrance certificate in its standard format to the parties. He issues a certificate after searching the computer records within 1 hour. The junior/senior assistant gives a computer-generated market value slip within 1 hour of application by the parties.

Requirement of Documents for House Registration Process in Telangana

Per the guidelines, you must upload all the documents to the online portal before going to the sub-registrar office to avoid delays in the procedure. As per the latest rule 2020, you require the following documents for property registration:

- The original documents, along with the signature of all parties.

- The certificate of Encumbrance.

- Bank Challan/Demand draft of the payment with whole stamp duty

- Property card

- Section 32A photocopy form of the executants and the witnesses

- Identity proof of the seller, witnesses, and the buyer.

- Power of attorney, PAN Card, Aadhaar card, and Address proof of the buyer and seller.

- Property’s exterior portion photograph.

- Agricultural land Pattadar passbook.

Registration Charges and Calculation of Stamp Duty in Telangana

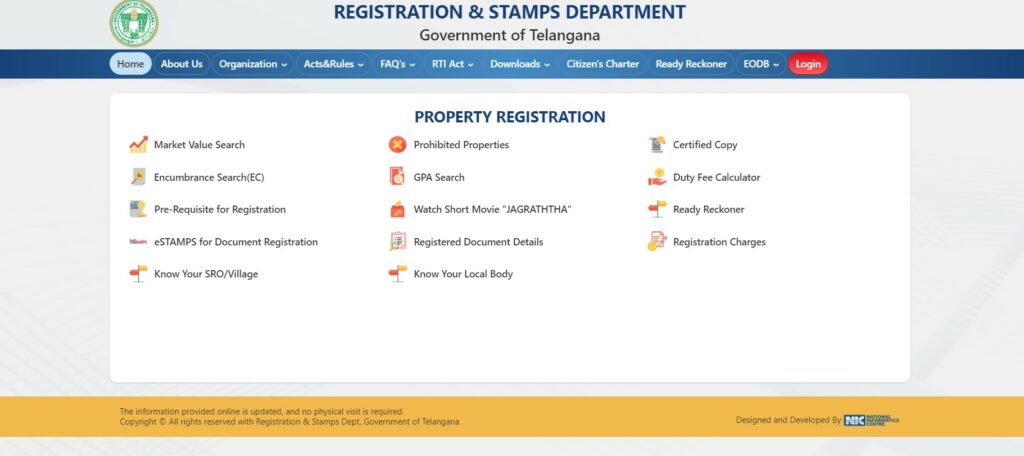

Calculating stamp duty and registration charges using Telangana’s registration and stamp department portal is elementary. Anyone can do it by following the steps given below. Clicking on the//registration.telangana.gov.in/TGMV_Client/NonAgri.htm will redirect you to the Registration portal and Stamp Department of Telangana.

Fill in the details of the nature of the deed, nature of sub-deed, and considerable value. Choose the suitable property type from the drop-down menu. Then fill in all the remaining details regarding the property.

After verifying the details that have been filled, the calculate button is clicked to get the result. A few elements are mandatory (*), and you must correctly fill them up before clicking the calculate button. On completing these steps, marketed value is easily obtained (this calculator is free of cost).

The calculation of the market value of the property is done by adding the land cost and structure cost of the property. The total amount of money payable includes the duty fees calculated with the addition of the stamp, transfer, and registration fees.

Things to Know Before Creating a Sale Deed in Telangana

The property owner must draft a sale deed of the needed value on a non-judicial stamp paper by a legal draftsman. Use of at least five non-judicial stamp papers by the parties is mandatory. The remaining duty can be paid as challan or any other medium per the guidelines provided by the state government of Telangana. You should include the below-mentioned clauses in the sales deed:

Type of Deed:

Don’t forget to mention the type of deed in the document. The type of deed can be mutually decided by the parties considering their interests related to the transfer of properties.

Information of Parties Involved in a Sale Deed:

You must mention the names, ages, and addresses of the parties involved in the transaction in deed. All the parties sign the deed after properly verifying the clause.

Description Regarding the Property:

The parties should adequately mention all the information regarding the property in the deed. In addition, it must include a description of the property, along with the identification number, area of the plot, its location, etc.

Sale Consideration Clause:

The seller and the buyer can mutually decide on the sale amount, which must be clearly mentioned in the deed. The amount which must be paid for transferring the property rights to the buyer must be mentioned.

Mode of Payment and Token Amount:

The mode of payment of the total amount and token amount, if any, must be mentioned in the clause.

Status of Possession and Date:

The date of transfer of possession and the actual date of residence must be mentioned in the clause.

Indemnity Clause:

It means that the seller is liable to bear all the statutory charges concerning the property, such as property tax, electricity charges, water bill, etc., before the transfer of possession to the buyer and must be included in the clause.

Steps Involved in a House and Property Registration in Telangana

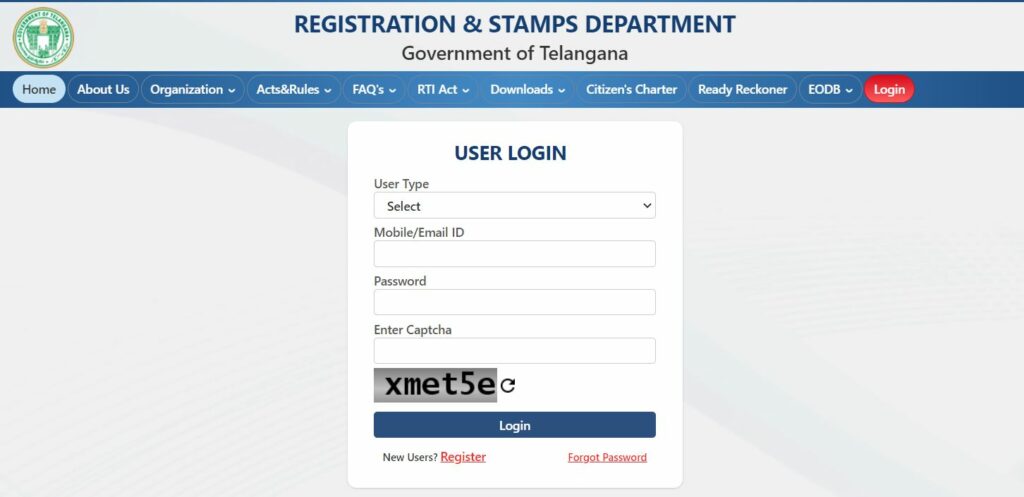

As per the new registration rules provided by the state government of Telangana, the procedure for house and property registrations is as follows. Click on this link to visit the Telangana Property Registration portal https://registration.telangana.gov.in/index.html. Create your login id.

However, after creating the user ID, all the documents need to be uploaded according to the requirements in the property registration portal of Telangana, along with paying the duty and registration charges. Then book an appointment to visit the SRO (sub-registrar’s office) and visit the SRO.

SRO will provide you with a check slip based on deed details uploaded to the online portal. Ask the SRO to make any changes in the title if needed. An E-KYC will be conducted after providing the slip. Fingerprints of the parties are collected and verified with the Aadhar database.

If the E-KYC verification is successful, the check slip provided by SRO is verified to confirm the payments of stamp duty, registration fees, and other fees, if applicable. After successful verification by the junior/senior assistant, the endorsements are printed on the registered documents. Then registration is done by the sub-registrar. The thumb impression of the parties is also collected.

Then the registered document will be scanned and uploaded to the Telangana land registration portal and can be downloaded by the parties using their user ID. Resubmit the application with necessary changes must be required in case of unsuccessful verification.

Payment of Stamp Duty on Purchased Property in Telangana

The registration charges and stamp duty can be paid quickly through the Telangana registration and stamp portal. Visit their online portal and select e pavement option provided under the online services section. On finishing, you will be redirected to another page.

The user clicks the property registration option, and the remitter details are inserted along with the party details, details of the amount remitted, and document information. Then register the profile to receive a 12-digit challan number and passcode. Payment can be made with provided challan number and passcode. After payment, print a copy of the challan that must be provided to the SRO during the house registration process in Telangana.

Identifying Outlawed Properties in Telangana before Purchasing

Before buying any property in Telangana, you must verify that it is genuine and does not fall under the prohibited category. For example, you can obtain the list of banned property from the Telangana land registration portal from the restricted property section.

Select the provided options in the portal appropriately, like the Mandal, district, and village, and choose the criteria accordingly. Like the Town survey number, Ward number/block number, Revenue survey number, Survey number, Survey number-wise details, Ward-wise details, etc. Click on submit button to obtain the list.

Evaluation of the Market Value of Property in Telangana with the Help of the Dharani Portal

The market value of agricultural land is only available in the Dharani portal. The user should visit the Dharani portal, and you must select the farm section. And along with this, you can click the option of ‘View Market Value of Lands for Stamp Duty.’ You should choose the district, village, Mandal, town, and survey number from the redirected page’s drop-down list. Then click on enter to obtain the market values.

Mobile App for Property Registration in Telangana

Download the ‘T-registration’ app the Telangana land registration department provides from the Google Play store. On registering, you will be provided with an m-pin. Log in with your m-pin number and enter the stamps and Challan details to obtain the land and property details. Enter the e-Challan details and passcode, and click the search button to get facts regarding your property registration.

Is it Compulsory for you to Receive Inherited Property Documents Listed in the SRO for the Patta/Khata Transfer?

After the property owner’s death, it belongs to the owner’s heirs or the person as per his will. Therefore, there is no such stern necessity of having a registered document. Instead, the SRO will transfer the agricultural land after the papers are produced to the Mandal Revenue Officer (under Andhra Pradesh Land Revenue Act). For sharing vacant land other than agricultural land, or property, the seller should visit offices of Corporation-Municipality, Panchayat, etc.

Property Registration in Telangana: Contact Information

For further details regarding the house registration process in Telangana, call the toll-free number1800 599 4788. You can mail them on the email id grievance-igrs@igrs.telangana.gov.in. You can also contact them on WhatsApp support number 91212 20272.

Recent Hike in Property Market Value in Telangana

In Telangana, the market value of the properties like open plots, flats, and agricultural land has increased by 35%, 25%, and 50%, respectively. However, the new and updated rates of the properties have come into effect by February 1, 2022. Also, the officials made alterations and updations to the official website’s software, i.e., IGRS Telangana, to display the revised rates.

After the up gradation and completing the review by the Commissioner and IGRS Telangana, they revised the properties’ market value charges. The study took place with the various committees constituted under the Telangana Revision of Market Value Guidelines Rules-1998 for changing the market values.

The Procedure for Mutation of Property in Telangana

The mutation of any property is transferring the title ownership name in the prevailing revenue department records. The transformation is the procedure for the transfer of title. It is usually done when the other owner purchases the property and transfers it to the previous owner.

The new owner can transfer the records to his or her name through the mutation of a particular property. In Telangana, the Greater Hyderabad Municipal Corporation carries the mutation process. However, the mutation document is necessary to settle the property tax payment liabilities.

If someone owns the property jointly, it is important to note that, in the mutation certificate, the names of all the co-owners should be present. The documents required for the property mutation process in Telangana are the attested copies of the property and linked records. Encumbrance certificate and Transfer Notice under section 208 of the GHMC Act that both vendors and vendee should duly sign.

Alongside these documents, for each copy of the document, you require non-judicial stamp paper for Rs. 20 and a tax payment receipt. This includes undertaking a Notarized Affidavit cum indemnity bond on the Rs.50 stamp paper.

Conclusion

The house registration process in Telangana is entirely legitimate and straightforward to follow for the people of Telangana. Even the time required for completing the registration procedure is significantly less, which is not suitable for the process. For example, people can apply for registration over the online platform after purchasing a house or any other property. The website of IGRS Telangana provides all the revised rates of the properties for the easy purchase of the buyers.

Both the property registration and mutation procedure are pretty simple and hassle-free because the officials of the IGRS Telangana always cooperate with the buyers of the property. Therefore, all the legal documents required for the registration procedure are mentioned thoroughly on the website of IGRS Telangana.