Registration | IGRS Bihar | Bhumijankari | Process | Fees | Bihar MVR | Land Gateway | Deeds

If you are looking to buy or sell a property in Bihar, you must ensure that all the relevant paperwork is in order. One of the most important paperwork involved is the property registration and stamp duty. Here we explain each of these and how to get them done quickly and easily.

Bihar land records and registration

In Bihar, land records and registration are handled by the state government. Acquiring land in Bihar is straightforward and can be done through various government agencies. To purchase land in Bihar, you must obtain a certificate of ownership from the appropriate government agency.

Once you have your certificate of ownership, you can proceed to register your land with the state government. Registration costs Rs 10,000 and requires a signature from both the purchaser and seller of the land. You can also pay for a stamp duty certificate, which will reduce the tax you must pay on your purchase.

What is IGRS Bihar?

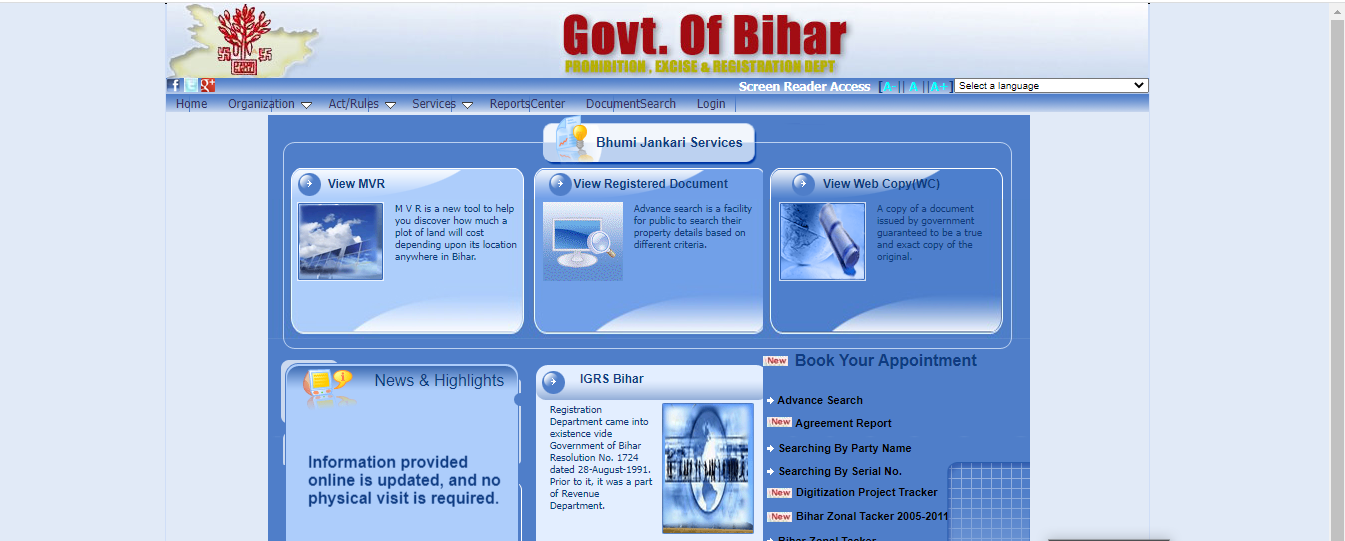

IGRS Bihar is an online property registration and stamp duty service. It helps you to register your property in just a few minutes and get all the necessary stamps and documents done in just a few days.

You can use IGRS Bihar to register your property in any of the 26 districts of Bihar. You can also use IGRS Bihar to get stamp duty registration, land title registration, and many more property-related services.

To start using IGRS Bihar, click the link below.

Bihar Bhumijankari registration portal

Bihar Bhumijankari registration portal is now open to the public. The portal provides information about property registration in the state of Bihar. The portal also offers information about stamp duty and other related taxes.

Bhumijankari, Bihar property registration process

If you want to buy or sell a property in Bihar, then registering it with the state government is a must. The property registration process in Bhumijankari can be daunting, but ensuring that your transaction goes smoothly is worth it. Here are some tips for registering your property in Bhumijankari:

- First, make sure you have all of the necessary paperwork. This includes a copy of your ID card, proof of residency, and proof of ownership (for properties bought or sold).

- Next, go to the property registration office in your district. You can find the office online or search for “Bhumijankari property registration” on Google Maps.

- Once you arrive at the office, look at the schedule and see if there are any upcoming sessions. If no sessions are scheduled for that day, you can register your property during one of the following sessions.

- Once you’ve registered your property, you will need to pay a fee. The fee depends on the type of property you are registering (house, land, building, etc.), but it usually ranges from Rs 500 to Rs 1000.

Bihar tax and registration fees

Bihar is one of India’s most populous states and has a high population density. This means there are many taxes and registration fees to pay in Bihar.

Here are some of the most common tax and registration fees in Bihar:

- Property Registration and Stamp Duty: This is the most common fee in Bihar, costing Rs. 300. This fee is payable when you register your property with the government.

- Income Tax: In Bihar, you must pay income tax on your gross income. The income tax rate in Bihar is 10%.

- Cess: You also have to pay a cess (a tax) when you purchase goods or services. The cess rate in Bihar is 2%.

- Service Tax: In addition to paying income tax, you must pay service tax on all your business transactions. The service tax rate in Bihar is 12%.

Bihar MVR -Minimum Value Register

IGRS has been functioning since 2006 in the state of Bihar. Our team of experts has vast experience in providing information related to property registration and stamp duty in Bihar. We have been providing comprehensive information on all the facets of property registration and stamp duty in Bihar. Apart from this, we also offer consulting services to clients looking for solutions related to their property affairs.

If you want to buy or sell a property in Bihar, you need to get in touch with IGRS. We can provide you with all the information you need related to property registration and stamp duty in Bihar. Our experts can help you navigate all the complexities involved in property dealings in Bihar. Contact us today if you want to know more about our services.

Bhumijankari, Bihar’s land gateway

Bhumijankari is the land gateway of Bihar. It is located at a distance of 152 kilometers from the state capital, Patna. The place has a rich historical background and is said to have been the last stopping point of the Mahabharata.

The Chandel dynasty earlier ruled Bhumijankari, and later on, it came under the control of the Mughals. In 1775, it became part of the British Raj and remained so till 1947, when India gained independence. The town was later merged with Champaran district as Bhojpur district in 1984.

The municipality was formed in 1995, and the present MLA is Ram Chandra Prasad Singh of the BJP. It has an area of 3,577 hectares and is bounded by separate districts- Saran, Vaishali, and Banka.

The municipality consists of four blocks- Jhanjharpur, Bhagwanpur, Mithapur, and Sonepur. The municipality has sixty-four panchayats- thirty-eight-gram panchayats; and twenty-four block panchayats.

Bhumijankari’s deeds on the portal

Bhumijankari, a registered society in Bihar, has opened up its portal to the public at www.bhumi.org. The portal is a one-stop shop for all property-related information and services in Bihar. Bhumijankari has partnered with various government departments to provide seamless and convenient services to the people of Bihar.

The society is also involved in land registration and stamp duty collection initiatives.

Bhumijankari is committed to making life easier for its members and the public by providing reliable information and services accessible anywhere in the state.

Summing-up

If you want to purchase property in Bihar, check out the latest registration and stamp duty information. Here is a summary of the current regulations:

- Property registration is mandatory for all property buyers in Bihar. You must complete the relevant paperwork and submit it to the authorities within 30 days of purchase. There is a nominal fee for this service.

- The tax on property purchases in Bihar is currently 10%. This will rise to 12% in 2020, but some exemptions apply, including first-time buyers and those buying agricultural land or land used for industrial purposes.

- Stamp duty is also payable on property transactions in Bihar. The current rate is 2% of the property’s value, but this will increase to 3% from January 1st, 2020.

For more detailed information on these regulations, be sure to consult with an experienced lawyer or tax adviser.