Overview | Paying PCMC Property Tax | PayTM Procedure | Property Tax | Tax Calculator | Rebates | GAT Number | Conclusion | FAQs

Undoubtedly, PCMC is one of the richest civic bodies in the municipal corporation that deals with manufacturing units, homes, properties, and more.

If you are a Pune resident, then you will be amazed that Pune Municipal Corporation is the second largest revenue producer in the town. PCMC collects taxes from more than six lakh properties as a direct source of revenue.

The ability to pay taxes online and offline on your property offers residents and business owners excellent facilities. Furthermore, one can visit the website and easily opt for many functions by choosing the desired language.

PCMC was registered in 1950 and still serves the town in many ways to the citizens. The taxing system is based on charging for personal property solely, and it can either be done for self-occupied businesses, office buildings, godowns, apartments, let out, and shops.

The ability to choose between different properties to fill out taxation details makes things quicker and easier. Here, we are elaborating on the complete procedure to pay PCMC property tax for different types of properties.

Also, read about tenant police verification in Pune.

Pimpri Chinchwad Corporation Property Tax – Overview

All those who have a clear understanding of PCMC property tax can skip the step by step to learn about the property tax payment process.

Pimpri Chinchwad is the urban agglomeration in the city of Pune, and PCMC or Pimpri Chinchwad Municipal Corporation is the municipal corporation body in the tax – as is clear from the name.

PCMC is responsible for the maintenance and services of public health management, water supply, road construction and maintenance, building maintenance, and much more. In addition, PCMC works in different fields related to the town’s growth.

Citizens get a wide range of services used by almost every citizen daily, and these premium services are possible with tax help. PCMC collects tax in various manners, and property tax on registration is a major source of revenue.

One can find property tax details by entering the property number, gat number, or using different methods. These methods help citizens pay taxes with ease and also help the town’s growth.

Step By Step Guide For Paying PCMC Property Tax Online – Updated 2022 Procedure

The method for paying PCMC Property Tax varies based on the property type. However, most of the basic steps are almost similar in most cases. You can follow the steps mentioned below:

Step 1: Visit the PCMC Website

To begin, you must visit Pimpri Chinchwad Municipal Corporation’s official website. You can click on the link, www.pcmcindia.gov.in/index.php or manually visit the website online.

You can find the resident option in the main menu bar on this website. After that, choose the property tax option from the resident menu.

Make sure you consider using a laptop with a compatible web browser like Google Chrome to ensure a flawless experience. This website may not function properly on smartphones. That’s why a computer seems like a better option.

However, there is an easy method for smartphone users, which we will discuss in the next section.

Step 2: Opt For Property Bill

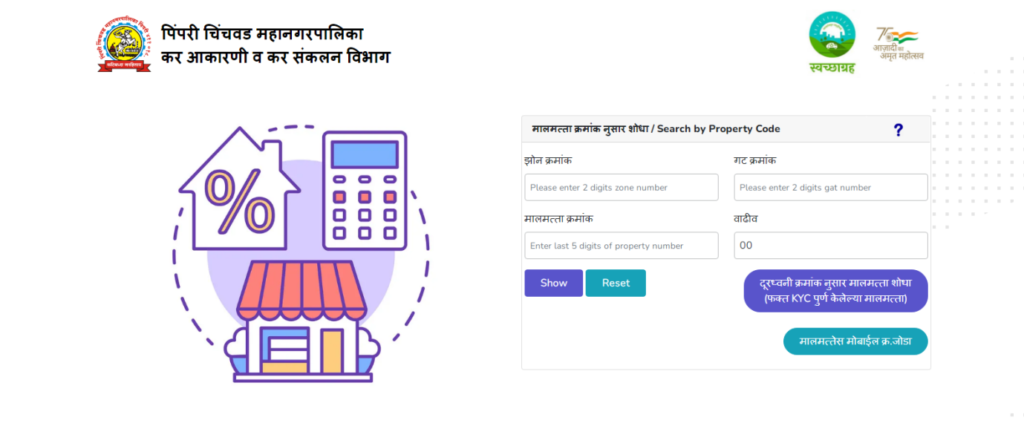

Once you click on the property tax option, it will redirect you to a new page of Pune Property Tax. This portal is dedicated to taxation purposes in Pune or Pimpri Chinchwad. The website works in multiple languages, so you can choose the desired option to make things easier. There are two different methods mentioned to check your property details.

Fill out the details adequately and double-check the information before clicking Show on the website. Then, you can either enter your Gat number or choose to use code or zone.

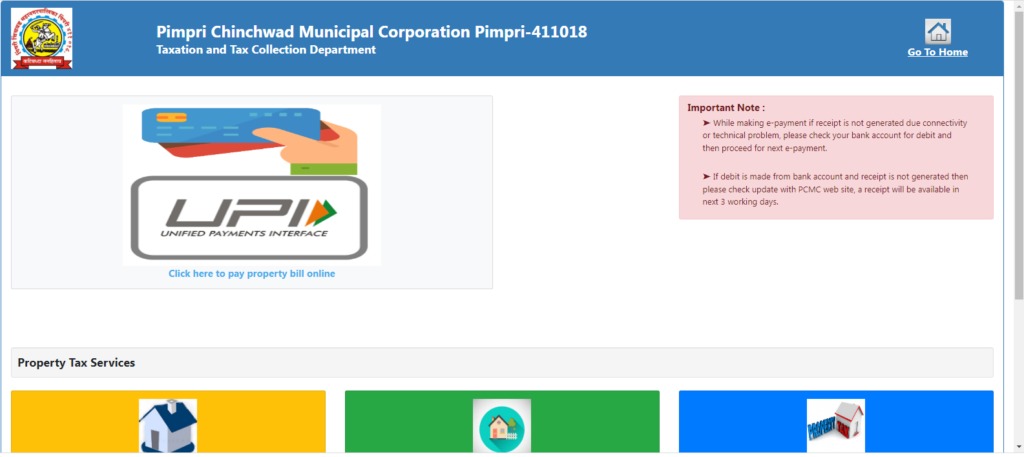

Step 3: Learn About the Property Tax Bill Payment

Once you click on the Show button, it will provide you with complete detail of the property tax, including the breakdown of different values. The same page offers you the option for payment. Click on the “Make your payment ” button, which will ask you to choose the payment mode.

Use any payment mode, and then add your mobile number and email ID for reciting. Once you make the payment, you have successfully paid the property tax bill.

Step By Step Guide For Paying PCMC Property Tax with PayTM- Updated 2022 Procedure

The method for paying PCMC property tax through PayTM is simple and easy. If you are a Paytm user, then you can simply follow the below-given steps –

Step 1: Open Pay Bill Option in PayTM

Paytm provides the functionality to pay bills, taxes, and much more through their smartphone app. Open the app and search for the pay bills option.

Step 2: Choose Corporation

You can search for PCMC and tap on it in the app menu. You will get plenty of details and a section to fill out the property bill. Choose the corporation option in this box.

Step 3: Enter Details

Make sure to collect all the basic documents nearby so you don’t get issues like Session Timed Out. Enter your details, including the property ID, address, Gat number, and email ID.

Step 4: Learn About the Corporate or Residential Property Tax

Once you click the proceed button, you get complete detail of property tax, including the breakdown of amounts you must pay. Check out the breakdown, and if everything is okay, click on make payment. You can choose between payment methods like UPI, Net Banking, or more.

Step 5: Complete the Payment

Complete the payment through any payment mode, and you are done after that. Make sure you pay the property tax in advance because there are many times when the property tax payment takes a couple of days to reflect in the PCMC server. Once you have completed the payment, everything is done, and you will get the recipe on the given Email ID.

The benefit of using PayTM is visible when paying the property bill again. PayTM offers reminders regarding the due date of PCMC so that you can pay the bill on time and avoid getting charged any late fee. This method is helpful in the long run and avoids any unwanted charges.

Knowing Your PCMC Property Tax Bill

The methods are helpful if you want to know the PCMC property or corporate tax bill before the payment.

However, an alternative method can help you get complete details based on the area, property size, and other factors. Follow the steps:

- Open the PCMC website, and you can do it by clicking on PCMC Property Tax Portal (https://propertytax.pcmcindia.gov.in/pcmc/pcmc?wicket:bookmarkablePage=wicket-0:com.common.property.reports.ReportTab) online.

- Now, click on the property section and enter details like the zone, gat number, owner, and other details to learn about the property tax details.

- Click on the show button to provide you with a detailed list, including the PCMC property tax and other key factors.

- You can find the “Total Amount to Pay” option, which will further provide the core details like how much tax you have to pay. You can also choose the taxation period and click on the “Show” button.

You will get a detailed list that will also help you pay the bills. Make sure you pay the property tax bill on time to avoid being charged with late payment fees.

Calculate Tax – PCMC Property Tax Calculator

One can easily calculate tax for Pune Municipal Corporation’s property tax based on a few key factors. You need a few following details, which will let you calculate the asset or property tax value in minutes. All you need is –

- Location of the residential or corporate property

- Area of the property

- Type of property – Residential or Corporate

- The Year of Construction

- Total Plinth of Area

Once you know all these details, you can follow the steps below and know about the tax value before payment. You can pay the tax online as well as through cheque or draft. However, you can get cash back or discounts in the online payment mode.

To manually calculate the property tax, follow the given steps:

- Multiply the capital value of the property with the rate of tax

The formula is – Rate of Tax X Capital value

Now, you will be wondering how to calculate the capital value of your property. Well, it is not that difficult. You can use the below-given formula –

- Capital Value = Base Value x Use Type X Building Type X Built Up Area X Property Age X Number of floors.

Once you calculate all these factors, you must multiply the number by the tax rate to figure out the exact value. However, PCMC offers discounted rates based on the property type and area, further reducing costs.

How to Get Rebates on Paying PCMC Property Tax?

Many methods can offer a huge advantage in reducing the property tax bill, which is helpful in various ways to save money. To begin with, the tax rebates are only available for specific criteria people.

- Women who own the property can avail ten per cent discount. However, to avail of this rebate, taxpaying women must pay the tax between April and May. If the amount exceeds Rs. 25,000, then they can avail five per cent rebate on the amount above this value. It is calculated similarly to income tax when used for rebate purposes.

- Servicemen and Ex-servicemen can also avail similar benefits to women. The condition of the rebate is similar, and the maximum amount of tax accumulated can be 24% in a year. The condition to avail of this benefit is before 30th June, which will also help prevent a late payment penalty.

Well, there is no doubt that these two rebate options are excellent for women and ex-servicemen, which can help save a good amount. Moreover, suppose you are heading toward the payment of property tax. In that case, the above-given methods can help save a pretty good amount, and it is also helpful in making other advantages.

Ward and GAT Number For Paying PCMC Property Tax

Below given is the GAT or Ward Number for PCMC. When paying PCMC property tax, you will need these ward number or Gat Number to complete the payment.

You can head to https://www.pcmcindia.gov.in/ward_info.php and learn about the Ward and GAT Number by this method. You can choose between areas to find the property in detail and find the right GAT and ward number for the same.

A&B Zones

| Ward number | Areas |

| 10 | HDFC Colony, Laltopi Nagar, Indira Nagar, Morwadi, Datt Nagar, Saraswati University School Campus, Vidya Nagar, Vrindavan Society, Ambedkar Nagar, Sambhaji Nagar, Shahu Nagar, Amruteshwar Colony, Sant Dnyaneshwar Nagar (MHADA) |

| 14 | Vitthalwadi, Shubhshri Society, Vivek Nagar, Chinchwad Station, Aishwaryam Society, Kalbhor Nagar, Mohan Nagar, Jai Ganesh Vision, Tuljai Vasti, Mahavir Park, Ram Nagar, Bajaj Auto, Dattawadi |

| 15 | LIC, Central Colony, Sindhu Nagar, Vahtuk Nagari, 26, 25, 27, Excise, Ganga Nagar, 28, Sector No. 24, Aakurdi Gaothan, Swapnapurti Society, Parmar Park, 27 A |

| 19 | Bhoir Colony, Bhaji Mandai, Valmiki Nagar, Sudarsha Nagar, Emperor Ashok Nagar, Buddha Nagar, New SKF Colony, Dr. Babasaheb Ambedkar Colony Part, Bhat Nagar, Sridhara Nagar, Niradhar Nagar, Wisdom Park, Queen’s Town, Vijay Nagar, Gawade Park, Pimpri Camp, Udyog Nagar, Mata Ramabai Ambedkar Nagar, Empire Estate, Sanitary Chal, Anand Nagar, Bhim Nagar |

| 16 | Gurudwara, Kivale, Ravet, Nano Home Society, Crystal City, Vikas Nagar, Royal Casa Society, Walhekarwadi part, Nandgiri Society, Mammurdi, Sector No. 29, Shinde Vasti |

| 17 | Bhoir Nagar, Aher Nagar, Nagsen Nagar, Chinchwade Nagar, Dalwi Nagar, Shiva Nagari, Bijli Nagar, Balwant Nagar, Giriraj Society, Rail Vihar Society, Premlok Park, Valhekarwadi Gaothan |

| 18 | Kakade Park, Pawana Nagar, Keshav Nagar, Yashopuram Society, Chinchwad Gaothan, Vetal Nagar, S.K.F. Colony, Moraya Raj Park, Darshan Hall, Tanaji Nagar, Lakshmi Nagar, Ruston colony, Manik Colony |

| 22 | Kalewadi, Vijay Nagar, Nirmal Nagar, Adarsh Nagar, Pawana Nagar, Jyotiba Nagar part, Nadhe Nagar. |

C To H Zones

| Ward Number | Areas |

| 2 | Chikhali gaothan part, Gandharva excellence, river residency, jadhavwadi, borhadewadi, crystal city, bankar Vasti, woods villa, kudalwadi part, raje shivaji Nagar, swaraj residency |

| 6 | Gulve Vasti, Dhavde Vasti, Chakrapani vasahat part, Sadguru Nagar., Bhagat Vasti, Pandav Nagar, Roshal garden premises |

| 8 | Gavali Matha, Balajiniguri, Khande Vasti, Maharashtra Colony, Indrayani Nagar, Jai Ganesh Empire, Jalvayu Vihar, Central Vihar |

| 9 | Udyam Nagar, Yashwant Nagar, Swapna Nagari, Masulkar Colony, Tata Motors, Vitthal Nagar, Mahindra Royal, Ajmera Society, Antariksha Society, Kharalwadi, Gandhi Nagar, Nehru Nagar, Vastu Udyog |

| 25 | ManeVasti, Kemse Vasti, Nimbalkar Nagar, Kate Vasti, Ashoka Nagar, Wakad Kala-Khadak, Swara Pride Residency, Tathawade, Munjoba Nagar, Navale Vasti, Punawale, Bhujbal Vasti, Rohan Tarang Society, Bhumakar Vasti, Wakadkar Vasti, Pandhare Vasti, Malwadi, Pristine Society |

| 26 | Dattamandir, Annabhau Sathe Nagar, Parkstreet, Anmol Residency, KaspateVasti, Dhanraj Park, Bharat Electronics, Pimpale Nilakh, Venu Nagar Part, Rakshak Society, Vishal Nagar |

| 28 | Kapse Lawns, Five garden, Rose Land, Kunal Icon, Planet Millennium, Govind Garden, Ram Nagar, Shivar Garden, Pimple Saudagar |

| 29 | VaiduVasti, Pimple Gurav, Bhalekar Nagar, Gulmohar Colony, Shivneri Colony, Sudarshan Nagar, Kranti Nagar, Gokul Nagari, Kashid Park, Jawalkar Nagar, Gagangiri Park, Kalpataru Estate, Onkar Colony |

| 3 | Vadmukhwadi, Sant Dnyaneshwar Nagar Part, Chovisawadi, Gandharva Nagari, Moshi Gaothan, Sai Temple, Tajnemala, Alankapuram Society, Dudulgaon, Kaljewadi, Gokhle mala, Charholi |

| 4 | Krishna Nagar Part II V.S.N.L. Ganesh Nagar, Bhandari Skyline, Ram Nagar, Gaikwad Nagar, Part-1 Dighi, Gajanan Maharaj Nagar, Samarth Nagar, Bopkhel Gaothan, Bharatmata Nagar |

| 5 | Chakrapani Vasahat Part, Sant Dnyaneshwar Nagar, Sawant Nagar, Gurudatta Colony, Ram Nagar, Gangotri Park, Gawli Nagar, Sant Tukaram Nagar, Shriram Colony, Mahadev Nagar |

| 7 | Shitalbagh, Gawhane Vasti, Khandoba Mal, Bhosari Gaothan, Suvidha Park, Apte Colony, Sandvik Colony, Shanti Nagar, Century Enka Colony, Landewadi |

| 1 | Chikhli Gaothan Bhag, Sonwavne Vasti, More Vasti Area, Patil Nagar, Ganesh Nagar |

| 11 | Mahatma Phule Nagar, Gharkul Project, Koyana Nagar, Purna Nagar, Ajantha Nagar, Nevale Vasti, Kudalwadi Part, Sharad Nagar, Durga Nagar, Krishna Nagar, Hargude Vasti |

| 12 | MIDC, Triveni Nagar, Tamhane Vasti Part, Sahyog Nagar, Mhetre Vasti Part, Rupi Nagar, IT Park, Jyotiba Temple, Talwade Gaothan |

| 13 | Yamuna Nagar, Nigdi Gaothan, Sector 22- Ota-skim, Sainath Nagar, Mata Amritanandamayi Math Campus, Srikrishna Temple Area |

| 21 | Indira Nagar, Shastri Nagar, Kailas Nagar, Dr. Babasaheb Ambedkar Colony part, Ganesh Nagar, Jijamata Hospital, Tapovan Temple, Baldev Nagar, Vaibhav Nagar, Ashok Theater, Adarash Nagar, Vaishno Devi Temple, Masulkar Park, Pimprigaon, Balmal Chal, Dnyaneshwar Nagar, Subhash Nagar, Gautam Nagar, Sanjay Gandhi Nagar, Milind Nagar |

| 23 | Padwalnagar part, Samarth colony Ganga Ashiyana, Ashoka Socitey, Thergaon Gavthan, Kunal Residency, Prasun Dham, Sainath nagar, Swiss County |

| 24 | Thergaon Gaothan, Sainath Nagar, Prasundhham, Samarth Colony, Padwal Nagar Part, Swiss County, Ganga Ashiana, Kunal Residency, Asoka Society |

| 27 | SNPP School, Tambe Shala Area, Galaxy Society, Shri Nagar, Baliram Garden, Rahatini Gaothan, Laxmibai Tapakir School, Sinhagad Colony, Royal Orange County, Shivtirth Nagar, Raigad Colony, Tapkir Nagar |

| 20 | Sant Tukaram Nagar, Vallabh Nagar, H.A. Colony, Kasarwadi part, Parshvnath Society, Kundan Nagar part, Agrasen Nagar, Mahesh Nagar, Landewadi slum, Vishal Theater Area, Mahatma Phule Nagar, CIRT |

| 30 | Keshv Nagar, Phugewadi, Ganesh Nagar, Sarita Sangam Society, Sanjay Nagar, Shankarwadi Part, Siddharth Nagar, Dapodi, ST Workshop, Shastri Nagar, Kasarwadi part, Kundan Nagar part, Sunderbagh Colony |

| 31 | Ganesh Nagar, Kavde Nagar, Kirti Nagar, Vidya Nagar part Part II Uro Hospital, Gagarde Nagar part, Part-1 Rajiv Gandhi Nagar, Gajanan Maharaj Nagar, Vinayak Nagar |

| 32 | Krishna Nagar, Jaymala Nagar, Dhore Nagar, PWD Colony, ST Colony, Sangam Nagar, Madhuban Society, Sangavi Gaothan, Sairaj Residency, Shivdatt Nagar |

Visiting this link will offer you complete detail of the area, along with the zone and further details regarding the property tax. It has become easier to calculate the tax based on the following information on the official website of PCMC.

The Final Verdict

Once you have learned about all the basic things related to PCMC and the payment methods, you can simply pay the bills online. The same method will help you calculate the property tax and other details. Make sure you pay the property tax in full instead of an initial amount to avoid getting charged late fees. Most people forget the due date and are charged hefty fees for the delay.

We hope this guide helped you learn about the complete method for paying PCMC property tax. Please let us know in the comment section if you have any queries regarding the property bill calculation or find anything wrong with our post.

FAQ

Is Paying PCMC Property Tax Online Possible?

Yes. You can visit PCMC’s official website, choose property type, and fill out details to pay the property tax.

Does PCMC Offer Any Rebate to Women on Property Tax Payment?

Yes, PCMC offers a rebate for ex-servicemen and women for the property. Availing of the rebate is easy, and you can simply visit the PCMC website to learn more.

What’s The Last Date for PCMC Property Tax 2022?

31 December is the last date to pay PCMC property tax for the second half. You can visit the official website of PCMC and pay the tax easily.

Do Defence Personals Have to Pay PCMC Property Tax?

PCMC recently announced the waive-off regarding Property tax for retired Defence Personals.