Advantages | Popular Platforms | CRED | MAGICBRICKS | PAYTM | PHONEPE | HOUSING | NOBROKER | Factors | Conclusions | FAQs

Credit cards are becoming very popular nowadays for instant rent payments for a reason. There was a time when only cash or NFT was considered the only medium for paying rent. But especially after covid situation, things have changed drastically. Credit cards are evolving as the dominant medium in the real estate sector for some of their significant features.

Landowners expect the rent within the scheduled time. What if the tenant doesn’t have enough cash at that time? To avoid the awkward situation, credit cards emerge as lifesavers.

In the following blog, we’ve discussed some of the popular features of 6 noteworthy platforms for paying rent through credit cards.

Also, read why paying guest accommodations is the best for those with limited liabilities.

Advantages of Paying Rent With Credit Card

Reward Points

Based on the monthly spending, all banks offer reward points. More reward points mean more facilities in the future. Unlike cash transactions, these reward points can be used for future purchases or bookings. Reward points and various attractive offers are also available based on credit transactions.

Credit Period

Banks offer a free credit period of 45 days. After paying rent using a credit card, if the user pays the credit card bill within 45 days, there is no interest charge. This short period of 45 days is considered a free credit period.

Cashback Offers:

Cashback offers are beneficial in some e-commerce portals and banks after using a credit card. This offer is really eye-catching as the cashback is directly transacted to the user’s account. So from now on, think twice before paying rent. Mere cash transactions don’t have this facility of cashback.

Minimum Formalities:

Payment through credit is a very seamless and smooth process with the additional benefits of security. If you prefer NEFT, filling up details every single time is time-consuming and monotonous.

But the platforms which give the chance to pay through credit card need to fill up the pieces for only one time. Here the account details of the landlords are also necessary for safe payment. So do this process for once, and you’ve secured the rest of the year.

Timely Payment:

Unable to pay the rent at the scheduled time can be a very embarrassing situation for the tenant. A credit card can save you from such an awkward scene by paying whenever you’re in need. There is also no burden of extra interest if the user pays the bill within the free period of 45 days.

Annual Spending Limit:

The users of credit cards sometimes feel it’s problematic to meet the annual spending limit of their credit cards. Giving the rent monthly through credit cards will easily make the limit without much complexity.

Boost Credit Score:

A bad credit score, say 750, can affect the transaction, and the individual may face problems borrowing loans. Frequent large transactions are advised to improve the score to avoid such a situation. But never use more than 30% of the credit utilization ratio because it may affect the credit score.

Top 6 Popular Platforms For Paying Rent Through Credit Cards

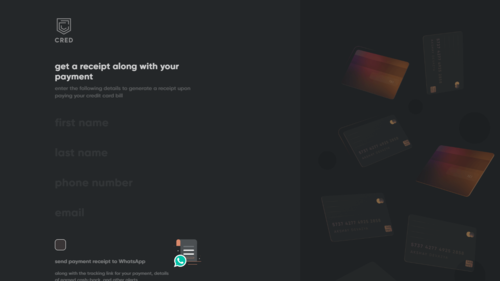

1. CRED:

CRED is one of the most popular platforms for paying rent through credit cards. It is one of the most secure and easy-to-use apps that offers easy and secure payments. It also offers reward points and cashback to make up for the nominal fee for using a credit card.

The use of cred is discussed as one of the easiest processes. With a few simple steps, you can register yourself, and you’re all set to pay safely for the rest of the time.

First, install the app from the app store and register yourself by entering phone no. Now enter the necessary details and set up an account without much hazard. Then go for the payment option and enter the amount you need. In the next step, enter the details of the landlord’s account. Now you’re eligible for payment, and proceed with the payment with a credit card option.

There are many reasons for choosing cred as a preferable platform for online rent payment.

- After paying the rent with a credit card on CRED, the money is transferred within two working days. The user also gets a reminder the next time when it is time to pay again.

- With every transaction, the user will get rewards, CRED coins, and many other offers to be used for future transactions.

- The CRED charge for using a credit card is very nominal. It only deducts 1-1.5% charges based on the network.

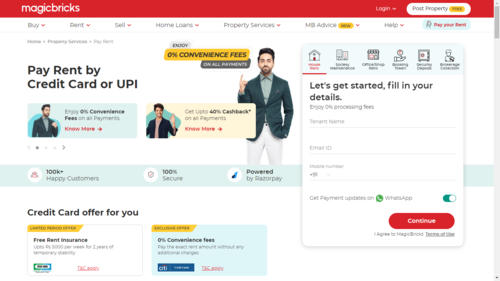

2. MAGICBRICKS:

MagicBricks is one of the leading e-commerce platforms for paying rent through credit cards and perform various commercial duties and payments via credit card. It is one of the cheapest platforms for paying rent, allowing the use of both Visa and Mastercard credit cards. It also offers a smooth payment experience with security and many benefits. The steps of making an eligible payment through magic bricks are as follow –

Provide all your credentials and necessary information regarding the user’s bank account and the land owner. Then proceed towards the rent details for an eligible payment. Then enter into the payment gateway and choose payment through credit card. The rent will be transacted very soon, and the landowner will receive it within one working day.

MagicBricks is popular among credit users as the facility it offers is admirable.

First, credit details and personal data are not stored anywhere and are never shared with any third party. MagicBricks also covers up to one lakh free rent insurance and accidental debt cases with regular use of it. Cashback, points, instant discounts, and offers from eminent brands are also available with every transaction on MagicBricks.

Transparency is what makes it widespread and trustworthy. The transaction fee is only one per cent, making it one of the cheapest platforms among all its competitors.

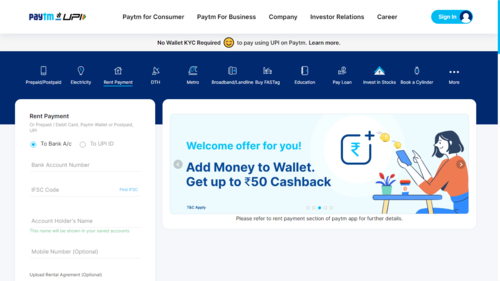

3. PAYTM:

Paytm is another highly secure, transparent, and popular platform in India. It also offers hassle-free rent transactions via credit cards. Not only for paying rent, but Paytm is also available for various types of transactions like recharging, booking tickets, purchasing various items, etc.

The additional benefit that Paytm offers is that the user can choose where to transact the rent- to the UPI ID or the landlord’s bank account. The steps of making payment are also very simple and straightforward.

After downloading the app from the app store, the user can deposit money directly to the landlord’s account by providing the account number, IFSC code, or UPI ID. Then enter the mobile number for safe payment and input how much money is needed. After entering the right amount, money will be transacted to the desirable account.

Paytm is popular in India for some of its interesting features. It provides a cashback offer with every transaction and a free credit period of 45 days. Almost 10 credit payments are possible with Paytm in a month. Moreover, the transaction fee is also very lower with Paytm. It is only one per cent.

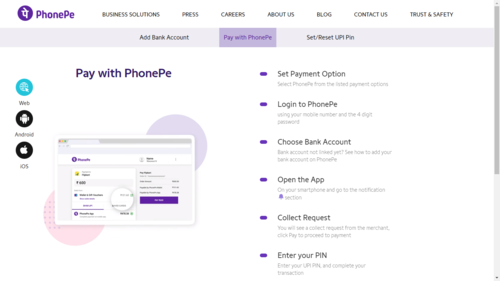

4. PHONEPE:

India’s one of the most popular and preferable platforms for paying rent through credit cards, PhonePe, has launched a rent payment feature with credit cards recently. It provides an easy, hassle-free, and transparent payment method that anyone can handle.

Paying rent from credit cards through PhonePe is more or less similar to the other apps, but this platform accepts credit cards from various banks, including American Express.

The process of making an eligible payment through PhonePe isn’t much different from the other apps. After installing the app from the Play Store or App Store, the user must provide all the necessary details to proceed toward a successful payment.

The best thing is that the user needn’t have attached the rent agreement here for paying the rent. It makes the process much simpler.

The range of banks from which it accepts credit card payments is plenty. The service tax after every payment via credit card is only 1.50%. It is even less than Paytm and CRED. Apart from that, the external benefits of cashback, vouchers, offers, exclusive discounts, etc., are also available with regular payments through PhonePe.

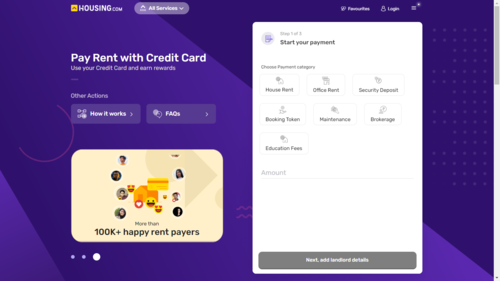

5. HOUSING:

Another one of the most important and secure platforms for paying rent through credit cards is Housing. Secured money transactions, a quick credit system, and a user-friendly process are some features that housing provides.

This rent payment app is powered by RazorPay. This app accepts all major credit cards for paying rent online. Notification is immediately sent to the user’s registered number after making an eligible payment.

Like the previous apps, the steps of making a successful payment through housing are simple. To activate the payment options on this platform, first, provide all the necessary details of the landlords. After making a successful transaction, the money will be transacted to the account of the land owner within two working days.

The reasons behind choosing Housing are many.

- Like other apps, it also provides cashback, offers, discounts, points, and other benefits to attract customers.

- Apart from that, the user can get 3% bonus reward points for some specific credit cards.

- Housing makes partnerships with eminent brands and banks.

- So the offer period, cashback, and discounts renew after every successful payment.

- With it, this app only charges only one per cent fee for every very nominal transaction.

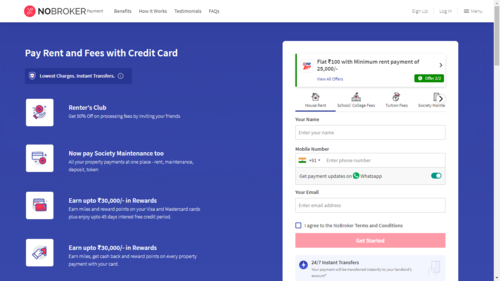

6. NO BROKER:

NoBroker is also one of the most preferred platforms for paying rent through credit cards. Not only rent payments, but it can also solve the purpose of other major payments through this app.

The procedure of the app is also very clear and easy to understand. Additionally, the user can also get a digital receipt after every payment. So keeping track or managing history is easy after using this app.

The process of making a successful payment through this app has nothing new in it. Put all the details of the user and the landlord, select payment with credit card options, and the money will be credited directly to the landlord’s account within two working days.

By using NoBroker, you can get extra benefits apart from cashback, discounts, and reward points. By inviting friends through this app, the user can save a 50% processing fee instantly.

Safe payment methods and security give this app extra mileage. Payzapp, Freecharge, Redgirraffe, etc., are some of the famous payment apps available in the market.

You can go for any app according to their choices and preferences.

Things to Keep in Mind

After all this discussion, there are some factors that you should remember before making a habit of using credit cards often.

- If you use credit cards for every payment, that will affect your credit score. It means that you spend more than your limit and always need credit cards.

- Making every rent payment with a credit card also signifies that the house rent is probably too high for you. You may not have the ability to pay for it by yourself.

- Regular payment via credit card may give an extra burden of heavy service charges. 2-4% extra charge will have to be deducted from the user’s account after the payment.

- In case of an emergency, it is advisable to ask for a grace period from the landowner. Because giving rent with credit cards means giving it extra interest in repayment. With every eligible payment of Rs. 50,000, the rental agreement must be uploaded to the platform. This increases an extra burden of complexity.

- A gentle suggestion is not to set auto-pay for rent payment. If the credit limit exceeds or the card expires, the payment will not occur, and you can miss the payment.

- If EMI is set with the credit card, the user will have to repay with much higher interest.

So try to set credit cards as the last rent payment option. Before that, in case of an emergency, you can try to borrow money from your friends. Always keep in mind and take notice of the terms and conditions of using credit cards.

Wrapping Up

Exploring new payment methods is always welcome to keep you updated with time. But you must keep checking each app from time to time because their offers and discounts fluctuate, and service fees don’t always remain the same.

Credit cards are always safe payment methods, and it saves you from the awkward situation of being unable to pay the rent. Better understanding will keep you safe and can protect you from economic disasters.

There is no reason to worry too much as the popularity of credit cards is increasing daily. Keep your eyes open and proceed towards making a successful payment.

FAQs

Why should I use credit cards for rent payments?

Credit cards provide you hassle-free experience by paying rent from home online. It also offers discounts, cashback, and more benefits after every payment. Many apps will offer you interest-free credit within 45 days.

Is it safe to use credit cards for online payments?

The e-commerce platforms that provide offers using credit cards for rent payments are extremely safe and secure. Your personal details are safe with them, and the transactions are made through a totally transparent method. So your money is safe with them, and there is no worry if you have provided all the details correctly.

What is the process of making an eligible payment through credit cards?

For making an eligible payment-

- First, provide all the necessary details of your bank account and of the landlord’s.

- Proceed towards the payment gateway and pay by using credit cards.

- The payment will be transacted to the landlord’s account within one to two working days, based on the policy of the platforms.

Can I pay house rent by using credit cards in India?

Yes! Apart from the platforms mentioned above, some other e-commerce platforms available in the market easily offer house rent payments through credit cards.

Is there any extra fee involved in paying the rent with credit cards?

Yes, credit may charge a 1-2% minimum process fee after every successful transaction. This fee depends on the terms and policies of the e-commerce platform.