Overview | Calculating Tax | Calculation Method | Generating PIN Steps | Online Tax Payment | Offline Tax Payment | Exemption | FAQ

If you live or own a property in Hyderabad, you must have come across the term GHMC (Greater Hyderabad Municipal Corporation) property tax. This tax is an expense that is paid by all property owners in Hyderabad city. The main aim behind this tax is to ensure the right maintenance of the facilities and amenities and to ensure the best infrastructure development as well.

An Overview Of The GHMC Property Tax Payment

The property tax in Hyderabad needs to be paid to the GHMC. This is a yearly payment unless you are exempted from the tax payment because you belong to a very special owner category.

So, let us see some of the key details with regard to this property tax Hyderabad payment.

Calculating The GHMC Property Tax

If you want to get an idea of the amount of property tax that you need to pay, here are some of the key details.

You can make use of the GHMC property tax calculator that is available online or you could try and decipher for yourself what payment you need to make.

The GHMC uses the annual rent system for calculating the property tax. This tax is to be paid by both residential and commercial buildings. An important point that we need to add here is that even if the building is not earning any rental income, it will still need to pay property tax. This is done because the building still has the potential to generate rent.

So, the tax is applied to keep the value of the property and the annual rent value in mind.

Here is a consolidated table to help you gauge the rates of property tax.

| The monthly rental value | Tax rate |

|---|---|

| Rs 50 | Nil |

| Rs 51-100 | 17% |

| Rs 101-200 | 19% |

| Rs 201-300 | 22% |

| More than Rs 300 | 30% |

The Property Tax Calculation Method

The GHMC makes it a point to conduct surveys of house areas that fall under its jurisdiction and fixes a monthly rent. This amount is calculated on the basis of plinth area per square feet.

The plinth area is actually the entire built-up area of the building. This will also include lawns, balconies, car parking, and more.

Let us cite an example to clear things up.

If suppose the monthly value per square foot for a bulling is Rs. 10 and the home measures 300 square feet, the monthly value of rent would be Rs. 3000

Now if you want to determine the annual value of the property, it will be Rs. 3000 * 12 which is Rs. 36,000

Now an important point we need to add is that as per the Hyderabad municipal body, the annual value of the property needs to be divided into two equal parts. These will be the land value and the building value. This helps in deciding the building’s age and the extended rebate that one can get on the payment of tax.

So, for the example cited above, the amount will be Rs. 18,000 for the case of land and Rs. 18,000 for the case of the building.

- For buildings that are less than 25 years old, the rebate is 10%

- For buildings that are more than 25 years old but less than 40 years old, the rebate is 20%

- For buildings that are more than 40 years old, the rebate is 30%

If suppose the building in our example is 30 years old, then it will be entitled to a rebate of 20 percent. So, the net annual rental value will be

Rs. 18,000 + Rs. (80% of 18000) = Rs. 18000+14400 = Rs. 32,400

As the monthly value is in excess of Rs. 300, you will be applicable for the 30% tax slab.

So, property tax will be 30% of Rs. 32400 = Rs 9720

Additionally, you need to pay a library cess of 8% on the tax amount

So, it is 8% of Rs. 9720 = Rs 778 (approx.)

The net property tax is Rs. 9720 + 778 = Rs. 10,498

Therefore, this is how the property tax is determined. We also recommend you check TDS on property sales too.

Generating Pin

The taxpayers should have their property tax identification number or the PTIN with them before they start the tax payment process. This a 10-digit number, for old properties, it is a 14-digit pin.

You need to send an application to the deputy commissioner of the city along with the occupancy certificate and the sale deed.

When the documents have been duly checked, a PTIN and house number will be issued.

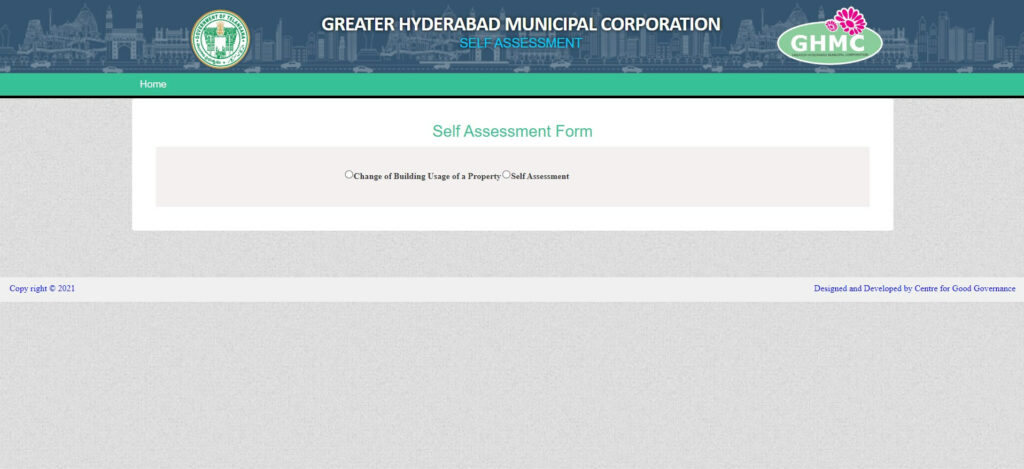

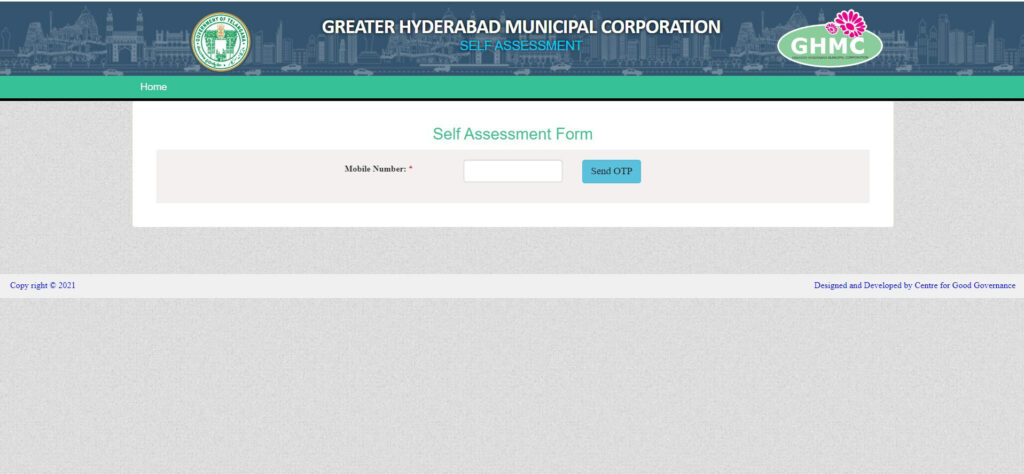

Steps To Generate The PTIN

Here is how you can generate the number online by following these simple steps.

- Head to the official GHMC site

- Now hover on online service and then click self-assessment of property

- Make sure to enter all the key details of the property. Check the details duly to ensure you are adding accurate details

- Once you do so, approximate annual property tax details will be listed on the screen

- Your application will automatically be forwarded to the deputy commissioner

- An official will visit the premises to make a check and the number will be issued to you

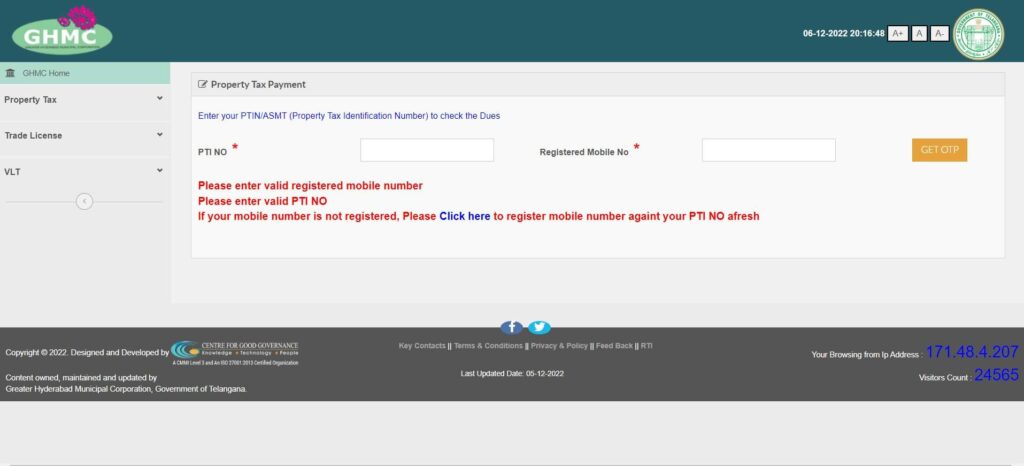

How To Make Online Tax Payment?

If you want to make an online tax payment, here are the steps you need to follow

- Head to the official GHMC website and hover over online payments

- Under this, select the option that reads Property Tax option

- Now enter your PTIN and then click on know property tax dues

- A new page will pop up where you need to verify the details that are listed

- Now choose your preferred mode of payment

- When you are done with the payment, a receipt will be generated. Make sure to keep a copy of the receipt and save it for your reference.

Paying The Tax Offline

If you don’t want to make the payment online, you can also pay the property tax in an offline manner.

- You need to visit the MeeSeva counter.

- Head to the citizen service centre

- Make sure to carry the right documents and then proceed with the payment

- You need to bring the sale deed, copy of the building plan, the occupancy certificate, and the demand draft or the cheque that should be drawn in favour of the GHMC commissioner

Exemption From The Property Tax

Under the following cases, property owners may not be needed to pay the tax

- Properties that have a monthly rental value of Rs. 50

- Owners of properties that are vacant get a concession of 50%

- Properties that are owned by charitable bodies

- Properties that belong to former military personnel

- Landlords whose annual income is less than Rs. 5 lakhs

So, if you fall into any of the above categories, you will not have to pay the property tax. Always remember, those with vacant buildings do need to make a payment but they get a hefty rebate as they are not making any money at the moment.

FAQ

Is it compulsory to pay the property tax?

Yes, it is absolutely compulsory to pay the property tax. This tax is payable to the government and your failure to do so can lead to strict legal action

Do buildings that are not generating any rent also need to pay the property tax?

Yes, these buildings too need to pay taxes because they have the potential to generate an income. However, vacant property owners get a concession of 50% on the property tax payment

Can you pay the tax in both online and offline mode?

Yes, you have the provision to make payment in either online or offline mode. It is entirely your call as to how you will like to pay it.

What happens if I lose my PTIN?

You can head to the GHMC official website and there are steps to be followed to retrieve your lost pin.

Is the PTIN number unique?

Yes, the PTIN number is totally unique and will differ from one property owner to the other. It is a system-generated 10-digit number.