RBI Ombudsman | Complaint Contact | Types Of Complaints | Homebuyer’s Provisions | Where To Lodge | RBI CMS | Other Details | FAQ

We all know how powerful and regulatory the RBI is. The RBI was set up with the prime aim of regulating the finances and ensuring that there was a body that could help people who were facing problems with other private and government sector banks. So, you have a provision to file complaints to the RBI. Ideally, you can file complaints against the different banks, the NBFCs, and the HFCs.

Often, it has been seen that people seem to be very disappointed when their concerns are not heard or addressed by the banking bodies or even the housing finance companies. So, what do you do in such cases? Who do you need to complain? The answer is The RBI.

The RBI has a befitting legal framework that has been designed in a way that helps the users to channelize their complaints. They are designed to give a solution to the deadlock and the problem. If you are wondering what is the segment under which you need to complain, it is the Reserve Bank – Integrated Ombudsman Scheme, 2021. This was launched recently on November 12, 2021, and is the part that was set up mainly for the sake of addressing the grievances that people may be facing.

Who Is The RBI Ombudsman?

Have you come across the term Ombudsman? The RBI Ombudsman refers to the senior officials who have been appointed by the baking regulators. Their purpose is to address the complaints that RBI receives from different customers. The complaints are mostly the ones arising due to the disturbance in the smooth operation of the banking services.

The list of possible RBI complaints consumers can file is duly listed under clause 8 of the banking ombudsman scheme, 2006.

Complaint Contact Details

Following are the details of how you can reach out to the different complaint officers and lodge your complaints. Based on the city you reside in; you can choose the right contact and thereby get in touch accordingly.

| City | RBI complaint address | Area of operation |

|---|---|---|

| Ahmedabad | N Sara Rajendra Kumar C/o Reserve Bank of India 5th Floor, Nr. Income Tax, Ashram Road Ahmedabad-380 009 STD Code: 079 Tel. No. 26582357 Email: cms.boahmedabad@rbi.org.in | Gujarat, Union Territories of Dadra and Nagar Haveli, Daman and Diu |

| Bangalore | Saraswathi Shyamprasad C/o Reserve Bank of India 10/3/8, Nrupathunga Road Bengaluru -560 001 STD Code: 080 Tel. No. 22277660/22180221 Fax No. 22276114 Email: cms.bobengaluru@rbi.org.in | Karnataka |

| Bhopal | Hemant Kumar Soni C/o Reserve Bank of India Hoshangabad Road Post Box No. 32, Bhopal-462 011 STD Code: 0755 Tel. No. 2573772 2573776 2573779 Email: cms.bobhopal@rbi.org.in | Madhya Pradesh |

| Bhubaneswar | Biswajit Sarangi C/o Reserve Bank of India Pt. Jawaharlal Nehru Marg Bhubaneswar-751 001 STD Code: 0674 Tel. No. 2396207 Fax No. 2393906 Email: cms.bobhubaneswar@rbi.org.in | Odisha |

| Chandigarh | MK Mall C/o Reserve Bank of India 4th Floor, Sector 17 Chandigarh Tel. No. 0172 – 2703937 Fax No. 0172 – 2721880 Email: cms.bochandigarh@rbi.org.in | Himachal Pradesh, Punjab, Union Territory of Chandigarh and Panchkula, Yamuna Nagar and Ambala Districts of Haryana |

| Chennai | Balu K C/o Reserve Bank of India Fort Glacis, Chennai 600 001 STD Code: 044 Tel No. 25395964 Fax No. 25395488 Email: cms.bochennai@rbi.org.in | Tamil Nadu, UT of Puducherry (except Mahe Region) and Andaman and Nicobar Islands |

| Dehradun | Arun Bhagoliwal C/o Reserve Bank of India 74/1 G.M.V.N. Building, 1st floor, Rajpur Road, Dehradun – 248 001 STD Code: 0135 Telephone: 2742001 Fax: 2742001 Email: cms.bodehradun@rbi.org.in | Uttarakhand and seven districts of Uttar Pradesh viz., Saharanpur, Shamli (Prabudh Nagar), Muzaffarnagar, Baghpat, Meerut, Bijnor and Amroha (Jyotiba Phule Nagar) |

| Guwahati | Thotngam Jamang C/o Reserve Bank of India Station Road, Pan Bazar Guwahati-781 001 STD Code: 0361 Tel.No. 2734219/ 2512929 Email: cms.boguwahati@rbi.org.in | Assam, Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland and Tripura |

| Hyderabad | T Srinivasa Rao C/o Reserve Bank of India 6-1-56, Secretariat Road Saifabad, Hyderabad-500 004 STD Code: 040 Tel. No. 23210013 Fax No. 23210014 Email: cms.bohyderabad@rbi.org.in | Andhra Pradesh and Telangana |

| Jaipur | Rekha Chandanaveli C/o Reserve Bank of India, 4th floor Rambagh Circle, Tonk Road, Jaipur – 302 004 STD Code: 0141 Tel. No. 2577931 Email: cms.bojaipur@rbi.org.in | Rajasthan |

| Jammu | Ramesh Chand C/o Reserve Bank of India, Rail Head Complex, Jammu- 180012 STD Code: 0191 Telephone: 2477905 Fax: 2477219 Email: cms.bojammu@rbi.org.in | UTs of J&K and Ladakh |

| Kanpur | PK Nayak C/o Reserve Bank of India M. G. Road, Post Box No. 82 Kanpur-208 001 STD Code: 0512 Tel. No. 2305174/ 2303004 Email: cms.bokanpur@rbi.org.in | Uttar Pradesh (excluding Districts of Ghaziabad, Gautam Buddha Nagar, Saharanpur, Shamli (Prabudh Nagar), Muzaffarnagar, Baghpat, Meerut, Bijnor and Amroha (Jyotiba Phule Nagar) |

| Kolkata | Rabindra Kishore Panda C/o Reserve Bank of India 15, Netaji Subhash Road Kolkata-700 001 STD Code: 033 Tel. No. 22310217 Fax No. 22305899 Email: cms.bokolkata@rbi.org.in | West Bengal and Sikkim |

| Mumbai-I | Neena Rohit Jain C/o Reserve Bank of India 4th Floor, RBI Byculla Office Building, Opp. Mumbai Central Railway Station, Byculla, Mumbai-400 008 STD Code: 022 Tel No. 23022028 Fax: 23022024 Email: cms.bomumbai1@rbi.org.in | Districts of Mumbai, Mumbai Suburban and Thane |

| Mumbai-II | SK Kar C/o Reserve Bank of India, 4th Floor, RBI Byculla Office Building, Opp. Mumbai Central Railway Station, Byculla, Mumbai-400 008 STD Code: 022 Telephone: 23001280/23001483 Fax: 23022024 Email: cms.bomumbai2@rbi.org.in | Goa and Maharashtra, (except the districts of Mumbai, Mumbai Suburban and Thane) |

| Patna | Rajesh Jai Kanth C/o Reserve Bank of India Patna-800 001 STD Code: 0612 Tel. No. 2322569/2323734 Fax No. 2320407 Email: cms.bopatna@rbi.org.in | Bihar |

| New Delhi-I | RK Moolchandani C/o Reserve Bank of India, Sansad Marg, New Delhi STD Code: 011 Tel. No. 23725445 Fax No. 23725218 Email: cms.bonewdelhi1@rbi.org.in | North, North-West, West, South-West, New Delhi and South districts of Delhi |

| New Delhi-II | Ruchi ASH C/o Reserve Bank of India Sansad Marg, New Delhi STD Code: 011 Tel. No. 23724856 Email: cms.bonewdelhi2@rbi.org.in | Haryana (except Panchkula, Yamuna Nagar and Ambala Districts) and Ghaziabad and Gautam Budh Nagar districts of Uttar Pradesh |

| Raipur | JP Tirkey C/o Reserve Bank of India 54/949, Shubhashish Parisar, Satya Prem Vihar Mahadev Ghat Road, Sundar Nagar, Raipur- 492013 STD Code: 0771 Telephone: 2244246 Email: cms.boraipur@rbi.org.in | Chhattisgarh |

| Ranchi | Chandana Dasgupta C/o Reserve Bank of India 4th Floor, Pragati Sadan, RRDA Building, Kutchery Road, Ranchi Jharkhand 834001 STD Code: 0651 Telephone: 8521346222/9771863111/ 7542975444 Fax: 2210511 Email: cms.boranchi@rbi.org.in | Jharkhand |

| Thiruvananthapuram | G Ramesh C/o Reserve Bank of India Bakery Junction Thiruvananthapuram-695 033 STD Code: 0471 Tel. No. 2332723/2323959 Fax No. 2321625 Email: cms.botrivandrum@rbi.org.in | Kerala, UT of Lakshadweep and UT of Puducherry (only Mahe Region). |

The Types Of Complaints You Can File

It is important to know that you cannot file just about any type of complaint. There are some specific details that you have to follow. Here are some instances you can choose to file complaints for.

Issuing unsolicited credit cards

A lot of times we are not in need of any credit cards but the banks still end up issuing one. In such cases, it becomes important to take the right action.

The RBI has a strict policy wherein they ask the credit card firms to neither upgrade the cards nor issue a fresh one without the consent of the customers. Under no scenario are credit card companies allowed to do so. If they are found guilty, as a penalty, they need to pay double the billed amount as the penalty.

An official statement from the RBI said, “The person in whose name the card is issued can approach the RBI ombudsman who would determine the amount of compensation payable to the card issuer for loss of the complainant’s time, expenses incurred, harassment and mental anguish suffered by him.”

Other complaint options

- If you feel that the banks are turning a deaf ear to your requests, you can choose to write to the RBI given your concern is genuine and the banking bodies are actually at fault.

- If you have filed for a home loan and your application was rejected, and you feel that there was a bias or you feel you are entitled to a lower rate of interest, you can write to the RBI ombudsman in such a case.

- If you find that the bank is a part of some wrongdoing against your account for any unexplained reason, you can choose to write to the RBI and file a complaint.

- If you feel that you deserve to get better interest rates on loans or deposits or your bank is not listening to your complaints, you have the provision to write to the RBI.

- Non-payment of cheques, bills, and drafts

- Non-payment or even delay in payment of remittances

- Refusal to open the deposit accounts without any valid reason for refusing it

- Non-acceptance of small denomination notes that have been tendered for any purpose

- Charging commission for change of currency notes from small to big denomination or vice versa

- Complaints from NRIs who have accounts in India for the sake of issues in remittances from abroad or even deposit-related matters

- Non-payment of inward remittances

- Non-adherence to the working hours as prescribed

- Refusal to open any form of deposit account without any logical or valid reason

- Delay in payment processing to the parties’ account.

- Noncompliance with the RBI directives

- Levying unwanted charges without any justified explanation

- Non-acceptance of coins tendered or asking for the commission to do so

- Delay in issuing drafts or bankers’ cheques

- Delay in offering banking facility for unexplained reasons

- Delay in accepting payment to be made towards taxes for no logical reason

- Non-observance of guidelines for engaging the recovery agents and using unfair means

- Non-adherence to the banking codes standards

- Refusing to issue redemption of government securities

- Non-adherence to the rules laid by the RBI for mobile or e-banking

- Failure to adhere to the RBI guidelines for sake of insurance or even mutual funds

- Delay in the disbursement of opinion and the error is on the part of the bank and not the individual

- Violation of any form of directives as issued by RBI with regard to the banking service

- Forceful closure of deposit account and that too without any prior notice or without any plausible reason to justify it

- Delay in the closing of accounts despite repeated requests by the customer

So, these are the wide range of complaints that one can write for. Of course, you have to be sure that your complaint is justified and valid at the same time. There are plenty of options you need to check duly. Mostly, whenever you feel that your bank has wronged you and it is a matter that needs to be heard, you can choose to head to the RBI complaint department and file your complaint accordingly

While there is no guarantee that the case will be ruled in your favour, the RBI is known to bring in the right changes. The RBI has an active board in action that works round the clock to ensure that they can offer the right justice as is the need of the hour. It is really important to have such regulatory checks or else banks may continue to exercise their free will and it is the end consumers that will end up being impacted.

Do Home Buyers Have The Option Of Lodging RBI Complaints Against The Bank?

Yes, the RBI grants home buyers the right to file a complaint against the bank if they meet certain criteria. There are clear details listed regarding the type of cases one can file against the banking bodies.

Here are some of the sensible scenarios wherein you can file the case.

- Failure to observe the RBI directives with regard to the rate of interest

- Failure to accept a loan application without giving any valid reason to the applicant

- Failure to adhere to the RBI directives in any of the banking matters

- Delays in sanctioning or disbursement of the loan applications and thereby not adhering to schedule as promised and failure to offer any explanation for it

- Inability to stick to the use of fair practises for lenders and thereby flouting the code of commitment for banks towards the customers

Where Do You File The RBI Complaints?

There are several methods of lodging RBI complaints and here we are going to elaborate on the details so that you can choose the one that seems best suited to you.

You can choose to write to the RBI. For this, you need to head to the RBI complaint management system (CMS). Here, you can choose to call the concerned office and then have the complaint lodged. Make sure to furbish clear and accurate details of what exactly happened to allow the RBI to take the right action and remedy the situation.

Alternatively, you can also choose to write a letter and then post it to the office of the Ombudsman. You are free to use postal services, fax, or even have it delivered in person as well. But, when you are doing so, never forget to attach the required documents that will act as proof of your complaints.

If you are complaining that a certain bank didn’t give you the home loan approval, you need to substantiate your claim with whatever legal documents it is possible to procure. It is imperative then that the complaint will only then be considered legit by the ombudsman.

You can also choose to file the complaint in an offline manner by physically heading to the office. Make sure to head to the centralized receipt and processing centre of the RBI and you can then have the complaint lodged.

While it isn’t mandatory, it is always advised to stick to the format that has been prescribed by the RBI for the sake of lodging the complaint. You can get hold of this format in any of the banks and if you stick to it, it will make things easier and smoother for you.

Using The RBI Complaints Management System Portal

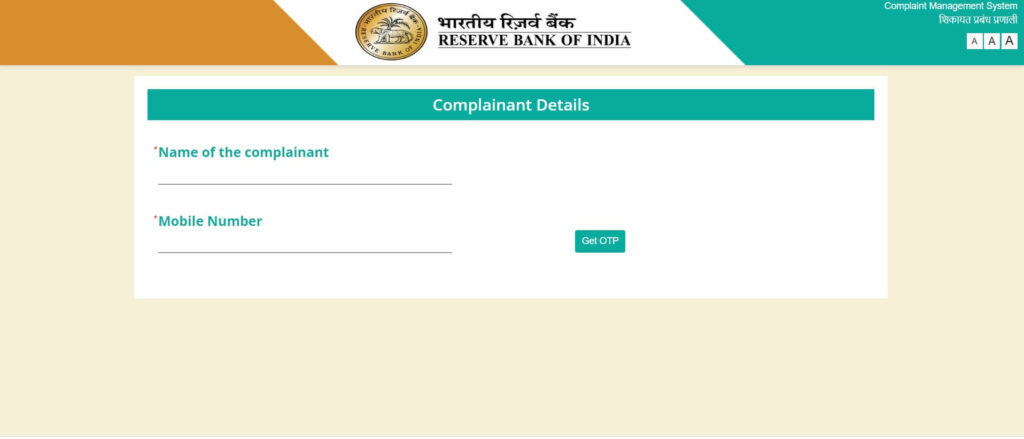

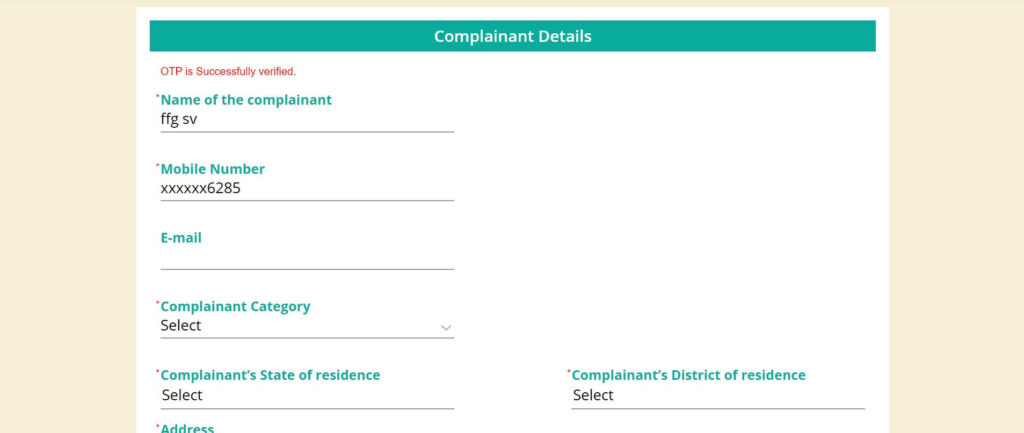

The RBI has a dedicated complaint management system in place to ensure customers can easily submit their grievances there. If you are wondering how to use it, we will walk you through the steps here.

- Head to the official CMS portal by clicking on the website link

- Now choose the option that reads File a Complaint

- On the top right corner of the page, you will have the option of choosing your preferred language. Make sure to pick the right choice

- The next thing is to select the type of entity. You need to select who the complaint is lodged against, whether is it a bank or a non-banking finance body or a housing corporation or a system participant.

- You will then be prompted to enter more details including the mobile number, the state, the name of the bank and so on. Make sure to fill in all the particulars accurately.

- If your complaint is with regards to credit cards, mention that in the required place. Fill in the particulars about the bank and also enter your Email id.

- Now check the declaration and select the nomination certifying on whom the complaint will be raised.

- Now hit on submit and your complaint will be lodged with the RBI

- After evaluation, they will decide the right course of action to be taken.

Important Details

We do understand that when you are lodging RBI complaints, there may be a few queries you may have in mind. Let us try to brainstorm those.

The compensation

A lot of people wonder about the compensation that they will get from the banks of the RBI rules the decision in favour of the customer. It pays to know that in case of disputes arising because of money matters, the refund amount will be either Rs. 20 lakhs or the amount arising directly out of the act. The lower among the two is always considered and offered as compensation. It is always owing to be greater than the disputed number.

Sometimes along with this, an additional sum of Rs. 1 lakh may be given for the mental agony and harassment that was created owing to the legal hassles and the disputes.

Not satisfied with the decision

In the rare event that you are not happy with the ombudsman’s decision, you can choose to take your case to the appellate authority of the RBI. If you are still not satisfied, you can move the RBI deputy governor. If it still fails, the consumer court will be your last and final bet.

The time frames

Ideally, the RBI ombudsman is going to take between six to eight weeks for the sake of resolving the issue. You may be contacted by the representatives from the bank during this period to confirm the complaint details and they act on it accordingly.

FAQ

When was the scheme for the ombudsman introduced by the RBI?

This scheme was introduced back in 1995 and was felt like the need of the hour owing to the innumerable disputes that were happening.

Is the decision by the ombudsman final and binding?

No, there is a higher hierarchy in the system where you can choose to request an appeal of the decision. The consumer court is the last and final bet after moving to all other steps.

Can you track the RBI complaints number?

Yes, you can easily track the complaint using the CMS portal and enter your unique id.