SBI CIBIL Score Meaning | Home Loan CIBIL Score | Documents | Influencing Factors | Check Your CIBIL Score | FAQ

SBI is the biggest public lender in India and if you are looking to avail a home loan, you will need to have a very good credit score. If this is what is on your mind too, you will need to be familiar with the CIBIL score. It is a very important score that ensures that you will be able to secure that coveted home loan that you truly desire.

So, let us dig more details into the concept of the SBI CIBIL Score.

What Do You Mean By SBI CIBIL Score?

CIBIL stands for Credit Information Bureau (India) Limited.

Therefore, the SBI CIBIL score refers to the criteria that the SBI uses for the sake of processing the loan request of the borrower.

The TransUnion CIBIL is one of the four companies that works round the clock for the sake of keeping the credit information of an individual. All the leading banks of India including the SBI uses this credit information and the complete credit history for deciding how safe it will be to sanction a home loan to a certain individual.

Banks duly need to check if an individual has the capacity of repaying the loan. The credit history contains a record of the ongoing transactions and even the credit card transaction details as well. This allows the information companies to paint a clear picture of the credit history of an individual and thereby understand their financial status in a much better manner.

The SBI currently charges an annual rate of 6.70% for home loans. This makes it one of the best times to get a home loan from this public bank. So, if you have made up your mind to procure a home loan from the SBI, it becomes even more important to become fully acquainted with the details of the CIBIL score and what it denotes.

The Home Loan CIBIL

If you have a credit score above 750, almost all the banks in the country will give you their lowest rate of interest on home loans.

You need to understand that anyone can choose to apply for a home loan, but whether or not your loan application is approved rests largely on the bank. Also, it is upon the banking officer in charge to decide the lowest rate of interest that they can offer. Mostly the rate is decided based on your risk score. The lower the risk associated with your score, the lower will be the rate of interest charged.

Right now, the best rate offered by SBI as far as home loans are concerned is 7.55%. Mostly it has been seen that applicants with a CIBIL score above 800 are much more likely to get this rate. You can also check out the list of best banks for home loans too.

Those applicants who have a CIBIL score lower than 700 will be charged a very hefty rate of interest on their home loan mainly because these will become riskier accounts.

This being said, it is important to know that the CIBIL score isn’t the only thing that the banks check when approving a home loan. The type of profession you are in, the income you generate, and your eligibility are all factors that will be duly assessed and will help you fetch a good rate of interest.

The Documents Needed For Home Loan

Here are the documents you should keep handy when applying for a home loan

- Three passport-sized photographs

- PAN Card

- Your SBI home loan application has been duly filled

- Address proof

- ID proof

- Bank account statement

- Original salary certificate from your employer

- Property documents including the sale deed

- TDS certificate on Form 16

Factors That Help In Deciding The CIBIL Score

There are a lot of different factors that influence your CIBIL score. You have to understand that each of these points is important and it is always healthy to maintain a good CIBIL score. Your inability to do so might impact your chance of securing a loan with your bank. It is the loan repayment history that largely impacts your credit score.

So, let us see some of the key factors.

- Loan payment delay

- A very high percentage of credit cards and even other loans

- Misusing the credit limit

- Too many inquiries about credits

So, make sure to keep these factors in mind to ensure that you can have a healthy credit score.

How To Check Your CIBIL Score?

Whenever you are applying for a home loan, you may be looking to check the CIBIL score. This will give you some idea of where you stand and a rough likelihood of your loan being processed.

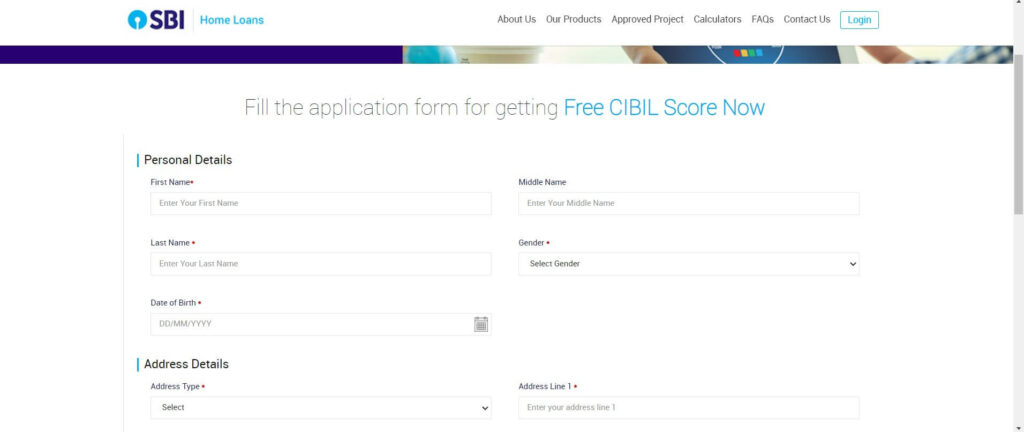

So, here are the steps you need to follow.

- Head to the official SBI portal

- Make sure to fill in your particulars

- Add the address, identity and even the contact particulars as well

- When you are done with the information filling, click on the box that asks you to accept the terms and conditions

- Now hit the submit button

- You may get a call from the SBI officials asking you for some more information. After this, you will be mailed the home loan SBI CIBIL report.

FAQ

What is the current rate of interest on home loans by SBI?

SBI is currently charging a 6.7 percent rate of interest on home loans. However, such low rates are only offered to those borrowers who have a very healthy credit score

Name the four credit information bureaus in India

The four credit information bureaus are TransUnion CIBIL, Experian, CRIF Highmark, and Equifax

What is the usual range of a credit score?

The credit score usually ranges from 300 to 900

Do you get low interest for a high credit score?

Yes, the higher the credit score, the lower should be the rate of interest. However, you have to understand that the banks do not just look at the credit score alone. Your income, personal eligibility and several other factors are also taken into consideration.

Can you check your CIBIL score?

Yes, you can check your CIBIL score by filling in several particulars on the official SBI portal. The score is emailed to you at the earliest after furnishing the particulars accurately.