Amendment | Calculating Stamp Duty | Salient Points | Influencing Factors | Refund Conditions | Filing For Refund | Paying Stamp Duty | Updates | FAQ

If you live in the city of Mumbai, you need to know the exact Maharashtra stamp duty and the charges that you need to pay. It is important to be mindful of these details as this will allow you to know clearly what charges will be incurred when you set out to buy a property.

Here we are going to share the key details with regards to buying property and will therefore prepare you in a better way as to which charges are the must that you need to pay and so on.

Ever since the state government announced an amendment, the stamp duty in the state of Maharashtra has increased by one percent. This will be effective from April 1st and will apply to all current properties.

An additional cess is going to be implemented in Mumbai, Nagpur, Thane and Pune. This has been done to raise funds for the better growth of projects in the field of transport and infrastructure. As the metro cess was introduced, the stamp duty increased to seven percent now.

The Amendment

Before this amendment, the stamp duty rate was five percent in Mumbai and six percent for all other cities of the state. The government also announced that if the property is purchased in the name of a woman, they will get a rebate of one percent. This rebate will not be applicable in the case of joint ownership. So, female property buyers surely have an extra discount to look out for.

Along with this, the government also called a bill wherein they extended the waiver period for stamp duty for investors for a period stretching to three years. Previously it was seen that investors used to sell their properties within a year of purchase.

This was done to make sure that they could earn the benefits of the waiver. However, owing to the change in rules, the investors can now wait longer. In such deals, the stamp duty charges are only paid on the difference in the amount of the property when sold off again.

How Is The Stamp Duty Rate Calculated?

Usually, the higher rate among the ready reckoner and the market value of the property as stated in the purchase agreement is considered for the sake of calculating the stamp duty rates.

Different states have their rates and slabs for stamp duty charges. In the state of Maharashtra, the rate varies within the state itself as the rate is lower in Mumbai as compared to other cities. A registration fee is charged above the stamp duty charges. This is why whenever you are looking to purchase a property, it is always advised to check out the details of the rates and then come to the right buying decision.

So, what is stamp duty?

Stamp duty is a kind of property tax that is paid by the home buyers and this is done when they are looking to purchase a property. Like the rest of the states, Maharashtra too has a separate stamp duty and registration charge that needs to be paid. This applies to all types of properties including but not limited to leasehold, freehold, residential flats, commercial properties, and more.

There is no denying the fact that such things end up becoming good earnings for the state and it happens to generate quite a significant amount of revenue.

The Salient Points

Now that we have established some of the key facts, we will like to share a few salient points as well about stamp duty rates in Mumbai.

- Different parameters influence the net stamp duty charge that you pay. This will include the area of the property, the age and gender of the owner, the market value of the property and so on.

- The area where your purchased land falls will have a lot of bearing on the stamp duty charges that you pay. If your land falls within the municipal locality or it is a very urban area, you are likely to end up paying more stamp duty charges and higher land tax.

- Similarly, if you buy land that falls within the limits of the panchayat, the stamp duty rates will likely be less. This is why it is always advised to keep an eye out on the details of the charges before making the final decision of buying a property.

- A commercial unit will include several amenities, modern features, extra floor space and more. This is why it is seen that commercial units tend to attract higher stamp duty charges as compared to regular residential ones.

Factors That Influence The Stamp Duty Charges In Mumbai

Here are some of the key factors that will affect the total stamp duty charges.

The age and gender of the property owner

Some states have a rebate for female property buyers. Maharashtra government for instance offers a 1% rebate in stamp duty charges if the property is purchased in the name of a woman. Similarly, older people, that is senior citizens, are likely to get a rebate on stamp duty charges too. However, it is always important to chalk the details with the respective state. This is because different states have their own rule in this regard.

The Property Types

Commercial properties will attract more charges as compared to residential properties. Similarly, the rates can vary from apartments to independent flats to penthouses and more. This is why you should always be well informed in advance. The rates are also subject to changes as several amendments take place from time to time.

The Location of the Property

If the property is located within municipal limits or falls in an urban area, it is likely to attract higher stamp duty rates. At the same time, if the property is located within the panchayat limits, it will end up attracting lower charges.

The Amenities

Those housing societies that have several high-end amenities to offer and give a lot of facilities are likely to attract great stamp duty. Those properties that have basic facilities and are not high-end complexes with a flurry of features will not have too high stamp duty charges.

Conditions For Stamp Duty Refund In Maharashtra

Here are some of the conditions that make you eligible for stamp duty refunds.

- If there are writing mistakes in the stamp paper and it is rendered unfit for use

- If any of the parties refuses to sign the stamp paper

- If any one of the parties refuses to agree to the terms and conditions mentioned on the stamp paper

- If the stamp paper is not signed

- If the stamp paper lacks complete information

- If the transaction has been deemed to be illegitimate in a court of law

- If the stamp paper has been spoiled but the transaction took place using another stamp paper document

- If one of the parties who needs to mandatorily sign the paper ends up dying before signing the paper

- If the value of the stamp on the document is insufficient but the registration gets completed with the correct denomination

So, if any of the above criteria matches your case, you can choose to file for a refund.

How To Apply For The Stamp Duty Tax Refund?

Here are the details you need to be mindful of when you are looking to get a refund.

- Head to the stamp duty refund page and use your mobile number for the sake of logging in

- A refund token number and password have to be generated

- You will be asked for several personal details that you need to duly fill in. Make sure to furbish accurate information for it

- Now enter details of the type of payment you will make, the stamp vendor, and the nearest SRO as well

- Register the different details and submit the token number to the respective SRO

How To Pay Stamp Duty Online?

Now a lot of people want to pay stamp duty charges online. This is because it eliminates the hassles of to and fro and saves people from unwanted hassles. So, if you too want to do so, here we are going to share the complete details and the steps.

The overall process has been made simple so that everyone will be able to pay their stamp duty charges online. As it is a mandatory charge, you will have to pay if you want to be the legal owner.

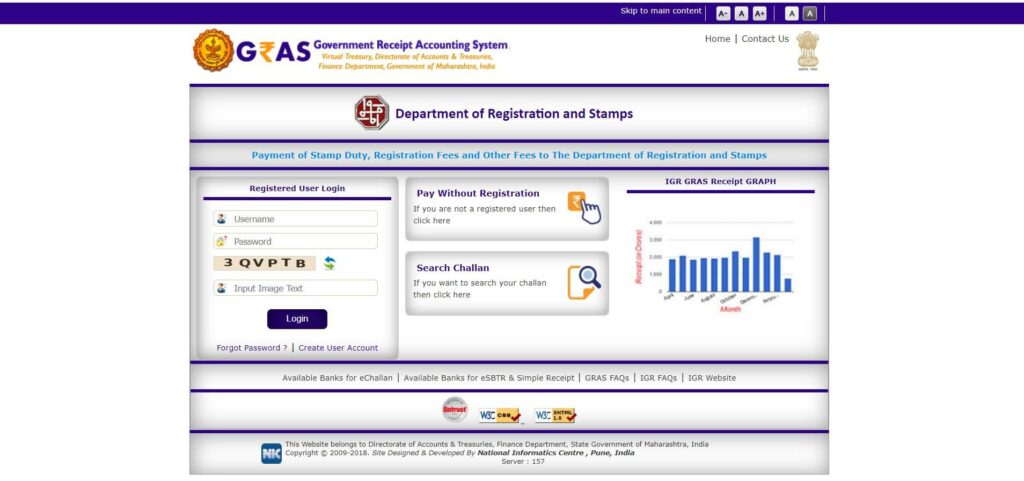

The e-stamp registration has made it easier for people to pay the stamp duty charges, the registration fee, and any other similar charges from the confines of their homes. The whole procedure of online stamp duty payment has been made simple, and transparent. It is also time efficient at the same time.

Here is how you can pay the tax online.

- Head to the Maharashtra stamp and registration department website

- Once you land on this page, make sure to fill up the information as asked. Always enter the right details asked. You will be asked to fill in details with regard to the area and the property as well

- When you have done all of this, you will then need to choose the right payment gateway. The stamp duty payment portal has tie-ups with all the major nationalized banks. So, you are not likely to run into any problems while making a payment.

- Choose the right bank and then follow the on-screen instructions for the sake of making the payment.

Latest Updates And News

As per the reports in the media, a lot of people are choosing to buy flats and apartments in Mumbai.

Every year seems to be better than the previous one as far as the sale of properties is concerned. This year, the sale of property rose by as much as 11 percent as compared to the last year. Most of the purchases made this year were largely residential properties. They ranged in size from 500 to 1000 square feet.

In July, as many as 11,000 property documents were stamped and this was the highest ever for this month in any year. Thus, the state government has been making a lot of money that is being generated from the revenue.

FAQ

Is it mandatory to pay the stamp duty Mumbai charges?

Yes, it is compulsory to pay the stamp duty charges. If you don’t pay these charges, you will not be considered the legal owner of the property.

Do women have to pay lower charges?

The stamp duty charges vary from one state to another. Some states offer a rebate to female property owners and they have to pay lower charges. The Maharashtra government offers a rebate of 1 percent to female property owners.

Does the stamp duty charge vary from one state to the other?

Yes, different states have their rates of stamp duty and they can vary considerably.

Can you get a refund on stamp duty Mumbai charges?

Yes, several instances make you eligible for refunds. You can choose to opt for a refund if you fit the criteria.

Can you pay the stamp duty online?

Yes, you have a dedicated online portal wherein you can choose to make the payment. Both online and offline payment methods are available for use.

Make sure to assimilate these details and then buy a property. The information will also help you when carrying out property transfers as well.