Stamp Duty Meaning | Influencing Factors | Checking The Market Value | Charges For Documents | Calculating Charges | Payment Mode | How To Make Payment | Claiming Refund | Grievance Redressal | FAQ

Whenever you are buying a property or even if there is just a change of ownership, it becomes important to have the papers registered and pay the stamp duty. Until and unless you do so, the property will not be deemed legal and the name transfer process will not be completed.

This is why we are going to share details of the West Bengal stamp duty and registration charge here. We will share all key information regarding this topic and will thereby prepare you with the type of charges you need to pay, the procedure to follow, and all other concerned points.

What Do You Mean By Stamp Duty?

The official legal paper that outlines the details of the property transaction needs to be registered on stamp paper. This has to be done in the presence of the sub-registrar. The value of the stamp paper is the stamp duty charge that you have to pay. The stamp duty charges are absolutely mandatory and you cannot avoid them. These charges end up going to the West Bengal revenue department and overall, they make a lot of money via these charges. It is an important source of revenue for the government.

Another great government initiative is the Banglar Bhumi for seeing the land records in the state.

The different states have varied rates as far as stamp duty is concerned. Even in the same state, the rates will differ as they depend on a wide variety of different factors. Let us see what they are.

Parameters On Which The Stamp Duty Depends

Here are the different factors that play a critical role.

Location

The location surely has a critical role to play. Properties located in rural areas have less stamp duty value as compared to those in urban areas.

The value

For properties whose value is less than 1 crore, the stamp duty charges are less compared to the ones that are valued above 1 crore.

The gender

A lot of states offer rebates if the property is registered in the name of a woman. However, the West Bengal State has no discrimination on the basis of gender and both men and women alike need to pay the same charges despite the gender.

So, these are some of the key factors. This is why when you are paying the stamp duty charges, you should check out the details of what are the actual charges and then come to the right conclusion.

Let us give you a more comprehensive detail of the stamp duty charges of each of the properties.

The West Bengal Stamp Duty Charge Details

If you buy a property worth Rs. 1 crore in a rural area, you will have to pay a stamp duty charge of 5% which is 5 lakh rupees. The same property when bought in an urban area will attract a stamp duty charge of 6 lakh rupees.

If you buy a property worth Rs. 2 crores in a rural area, you will have to pay stamp duty charges of 12 lakhs as the rate is 6%. The same value of the property when purchased in an urban area will attract stamp duty charges of Rs. 14 lakhs. The registration charges for all scenarios are fixed at 1%.

How To Check The Market Value Of The Properties?

Both buyers and sellers of properties have the option of checking the market value of the different properties in West Bengal in an online manner. This is a great way to make sure that you are not being hoodwinked while choosing to buy a property or even sell one.

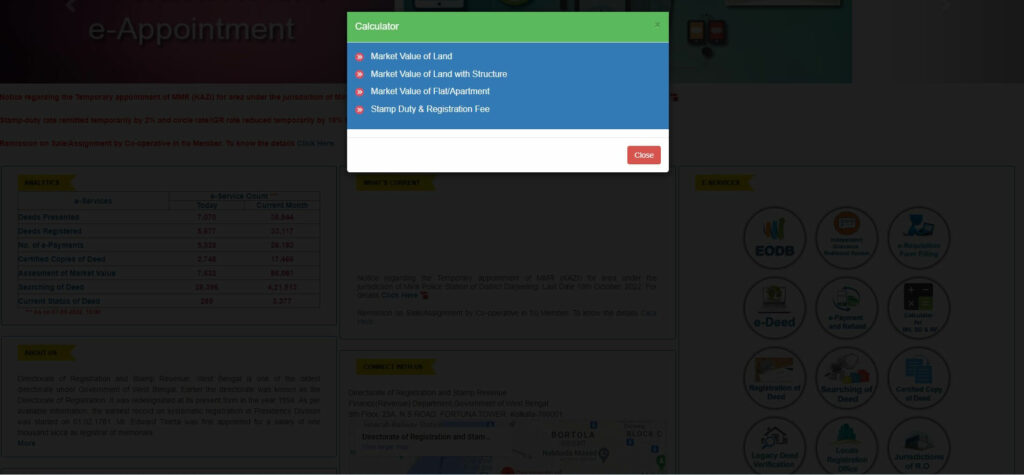

- Head to the official site of the West Bengal Registration portal

- On the home page, choose ‘Calculator for MV, SD, and RF’ from the menu

- A new pop-up will come with several options

- Choose either of the first three options which are named market value of land, the market value of land with structure, the market value of the apartment and stamp duty and registration fee

- You will be prompted to fill in several details. Make sure to fill the details in an accurate manner

- The value will then be calculated and displayed on your screen

This is the current market value of the property. Of course, when you are buying or selling it, the amount can deviate from it. However, it is always advisable to have an idea of the exact market value as this allows you to make a better assessment of the different details.

Stamp Duty On Property Documents

The different legal papers have varied stamp duty and registration fee charges. We are going to list the complete details of what charges will be incurred based on the type of paper you have. It is absolutely essential to be mindful of these details as they will help you sketch an estimate of the net cost that will be incurred.

| Document/Instrument | Stamp Duty Charges | Registration Fee |

|---|---|---|

| Power of Attorney (Property market value no more than 30 lakhs) | Rs. 5000 | Nil |

| Power of Attorney (Property market value more than 30 lakhs but less than 60 lakhs) | Rs. 7000 | Nil |

| Power of Attorney (Property market value more than 60 lakhs but less than 1 crore) | Rs. 10000 | Nil |

| Power of Attorney (Property market value more than 1 crore but less than 1.5 crore) | Rs. 20000 | Nil |

| Power of Attorney (Property market value more than 1.5 crore but less than 3 crore) | Rs. 40000 | Nil |

| Power of Attorney (Property market value more than 3 crores) | Rs. 75000 | Nil |

| Partnership deed (Value up to Rs. 500) | Rs. 20 | Rs. 7 |

| Partnership deed (Value up to Rs. 10,000) | Rs. 50 | Rs. 7 |

| Partnership deed (Value up to Rs. 50,000) | Rs. 100 | Rs. 7 |

| Partnership deed (Value exceeding Rs. 50,000) | Rs. 150 | Rs. 7 |

| Gift deed (Given to family) | 0.5% | Same as conveyance deed |

| Gift Deed (given to non-family members) | Same as conveyance deed | Same as conveyance deed |

| Transfer of lease (Government land given to family members) | 0.5% of the market value | Same as conveyance deed |

| Transfer of lease for all other cases | Same as conveyance deed | Same as conveyance deed |

| Sale Agreement (market value no more than Rs. 30 lakhs) | Rs. 5000 | Rs. 7 |

| Sale Agreement (market value more than Rs. 30 lakhs but less than Rs. 60 lakhs) | Rs. 7000 | Rs. 7 |

| Sale Agreement (market value more than Rs. 60 lakhs but less than Rs. 1 Crore) | Rs. 10000 | Rs. 7 |

| Sale Agreement (market value more than Rs. 1 Crore but less than Rs. 1.5 Crores) | Rs. 20000 | Rs. 7 |

| Sale Agreement (market value more than Rs. 1.5 Crore but less than Rs. 3 Crores) | Rs. 40000 | Rs. 7 |

| Sale Agreement (market value more than Rs. 3 Crores) | Rs. 75000 | Rs. 7 |

Calculating The Stamp Duty Charges

If you want to know how to calculate the stamp duty charges, here are the details and steps you must follow.

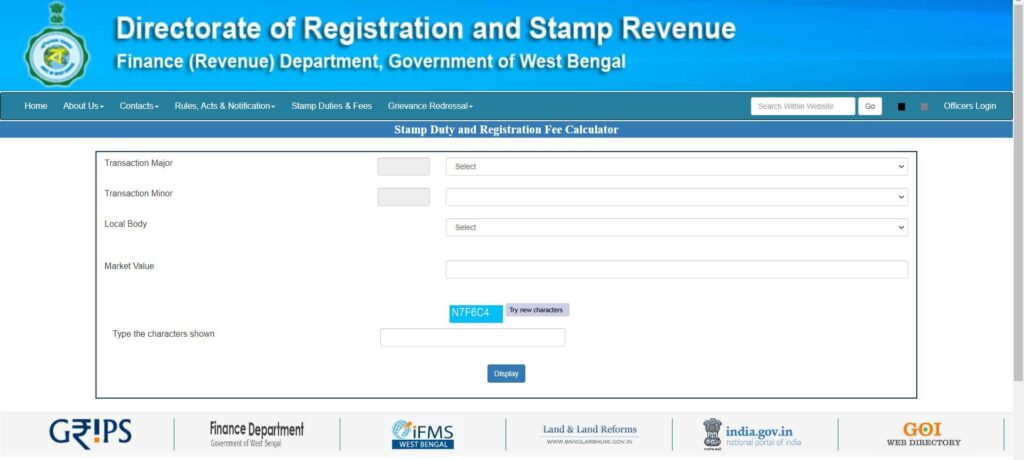

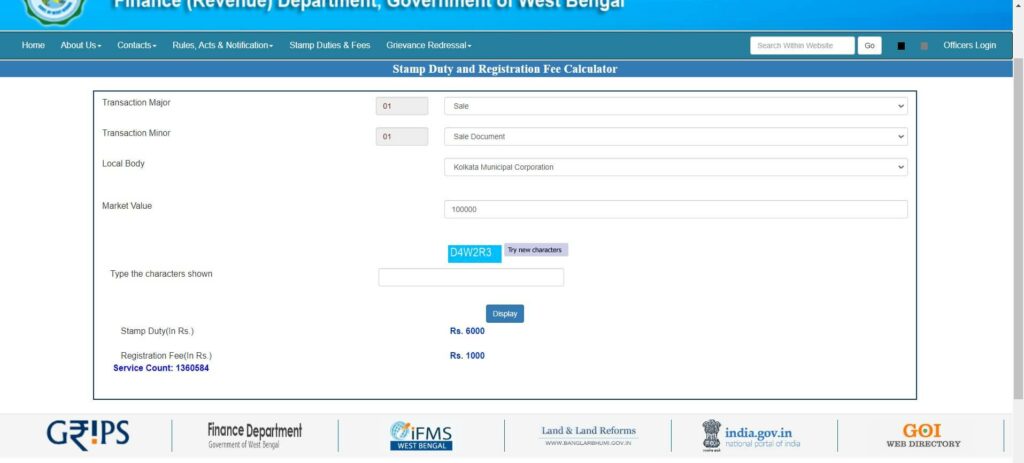

- Head to the registration and stamp revenue site of West Bengal

- On the home page, you will find a tab that reads ‘E-Services’.

- Hover on that and click on ‘Calculator for MV, SD, and RF’

- You will head to another page and there will be four options listed there. Choose ‘Stamp duty and registration fee’ from the list

- Once you do so, you will land on a new page which will be the stamp duty and registration fee calculator

- Make sure to enter all the details meticulously and then enter the capital as well

- Click on the Display button

The charges will then be listed on your screen for your reference

Payment Modes For Stamp Duty Charges

You can choose to make stamp duty charges through one or more of the below-listed methods.

- Demand draft

- Cash

- Pay order

- Cheque

- RTGS or NEFT

- Bank transfer

Before you make a payment, make sure to once get in touch with the nearest e-stamping centre. There may be additional bank or payment gateway charges. Confirm that from your chosen banking institute.

How To Make West Bengal Stamp Duty Payment?

You can only make the payment after your e-deed has been approved.

If you want to make payment of West Bengal stamp duty for any kind of property transaction, follow these steps.

- Head to the official website for WB registration

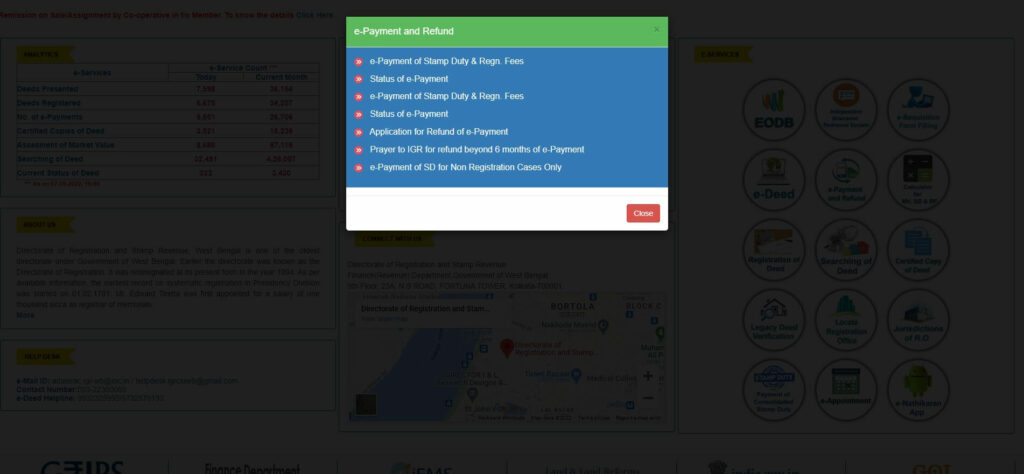

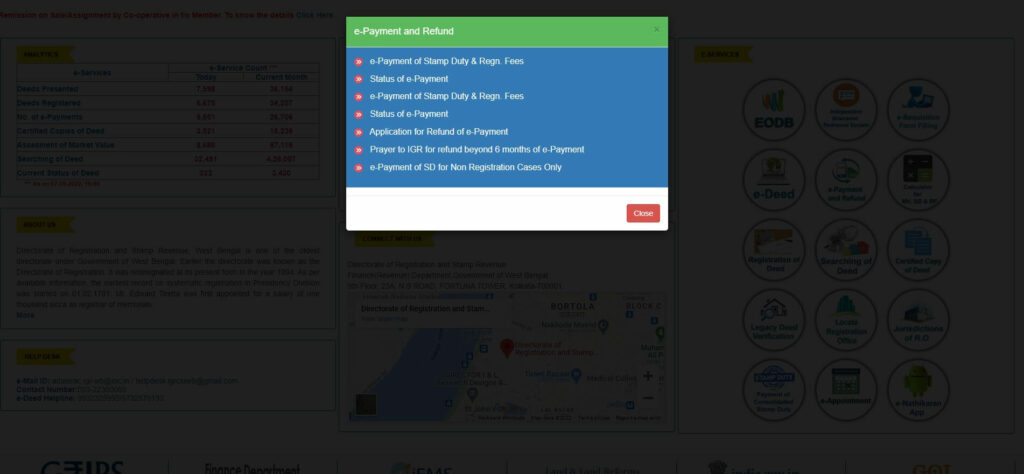

- Hover to the option E-Services and choose E-payment and Refund from the list

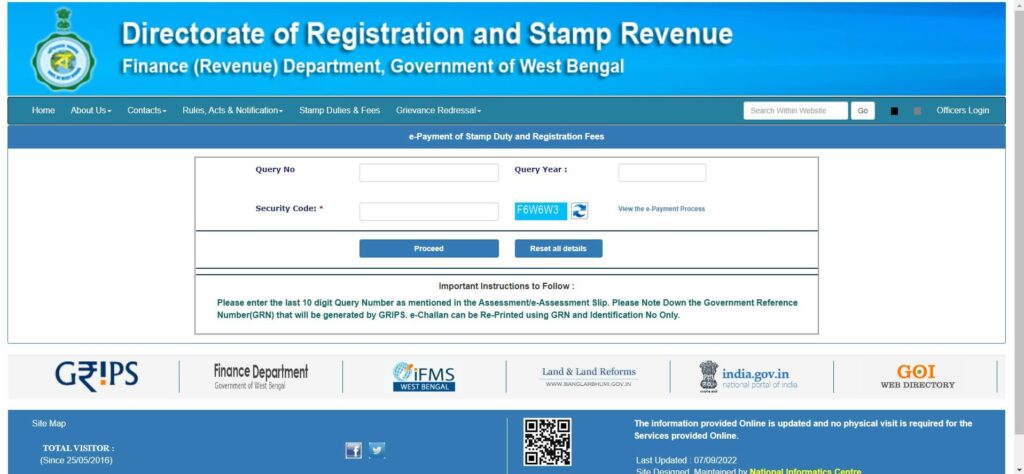

- On the page that pops, choose the option that reads ‘e-Payment of stamp duty & Regn. fees’

- A new page will come that will prompt you for further details. Fill that in and click on ‘Check Query Status’

- Now enter the details as asked to complete your banking details. Now, click on ‘Proceed for e-Payment’

- Now a pop-up button will come and you need to press Ok

- You will land on the new page and here you have to choose the make payment option

- On the page that pops up, choose ‘Select Department/Directorate’ section. Under this tab, choose ‘Directorate of registration and stamp revenue’

- Enter the depositor’s details and the payment mode and make the payment as per on-screen instructions

The Refund Of West Bengal Stamp Duty

There are a few exceptional cases wherein the West Bengal government has now permitted the users to claim a refund of stamp duty and registration charges that were paid online. Of course, you need to meet the criteria. Here are some of the details you need to follow for the sake of claiming the refund of West Bengal stamp duty and registration charges.

The charges will only be refunded if the document was not presented to the sub-registrar for the sake of registration. Once it has been registered, it is considered binding and the refund cannot be initiated

Here are the steps you need to follow to apply for a refund.

- Head to the home page of the WB revenue department

- Head to the e-services tab and choose the ‘E-Payment and refund’ option

- A new pop-up will come and you should choose the option that reads ‘Application for refund of E-Payment’

- Now you will be asked to enter the query number along with the query year and the GRN Number. This will help you search for the payment details.

- You need to upload supporting documents which are the following: The claimant’s copy of E-Challan, the copy of the valuation report, documentary evidence that states that the agreement has been duly cancelled, the cancelled blank cheque, and the original document that was partly executed.

- If the refund is applicable, it will be credited to the same bank account whose details you had entered while making the payment

List Of Properties Exempted From West Bengal Stamp Duty

The only property purchase that is exempted from stamp duty is the land purchased by the government departments. Any other transaction will need to pay the stamp duty charges.

Grievance Redressal

If you have any complaints regarding stamp duty and registration charges, you can choose to head to the grievance cell. The grievance cell has been put into place for the sake of listening to the complaints that the users have and then deciding the right remedial measures to be taken.

Make sure to enter the details thoroughly and explain the problem you may be facing. You will have to fill in complete particulars of your personal information and also upload the supporting documents if any.

You will be allotted a grievance ID that you can use for the sake of checking the status of your complaint.

FAQ

Which state offers the highest stamp duty charges in India?

Mizoram has the highest stamp duty charges as it levies a rate of 9%

What is the registration charge in West Bengal?

The registration charge in west Bengal is currently 1%

Were the west Bengal stamp duty charges reduced?

The stamp duty charges were briefly cut down from July 7th, 2021 to March 31st, 2022. The government cut down the stamp duty charges by as much as 2% during that period across the different categories.

Is the stamp duty charge fixed?

No, the stamp duty charges depend on a lot of different parameters but mainly the locality. It varies from 5% to 7% based on the area, location, and property value as well.

Different states have their own stamp duty rates. Find Andhra Pradesh stamp duty details here,